This market will depend on outcome of British vote. I will wait until the dust settles.

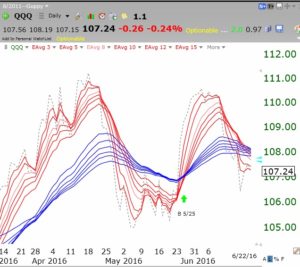

2nd day of $QQQ short term down-trend; $SPB strong Zika play

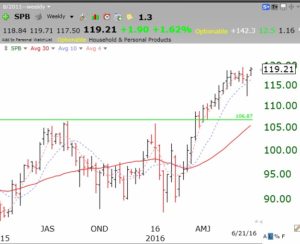

SPB has been climbing. It makes insect repellents! Here is weekly chart, showing GLB in March.

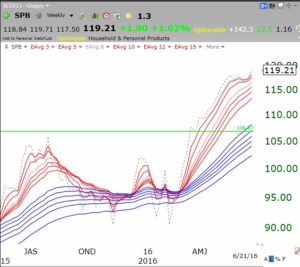

It also has a strong RWB rocket pattern.