The QQQ (and SPY and DIA) remains in a strong RWB up-trend with all averages lined up perfectly. Maybe too perfect? Beware of likely post earnings release lull and the Fed…. Sell in MAY?

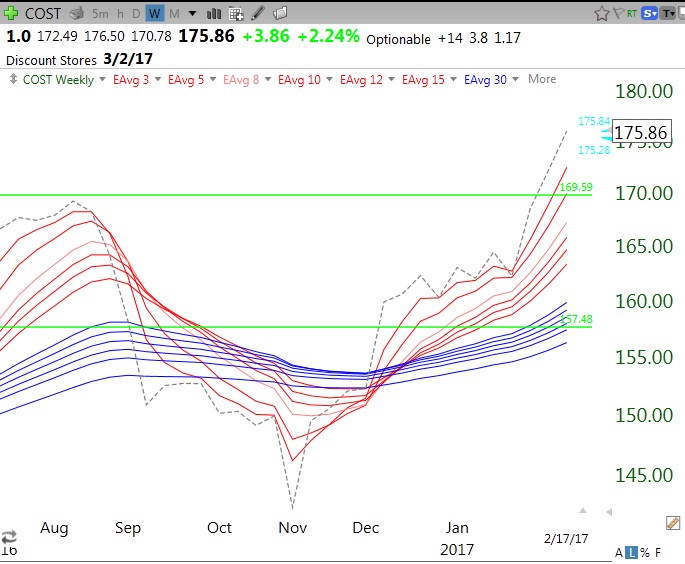

COST has a GLB to an all-time high.

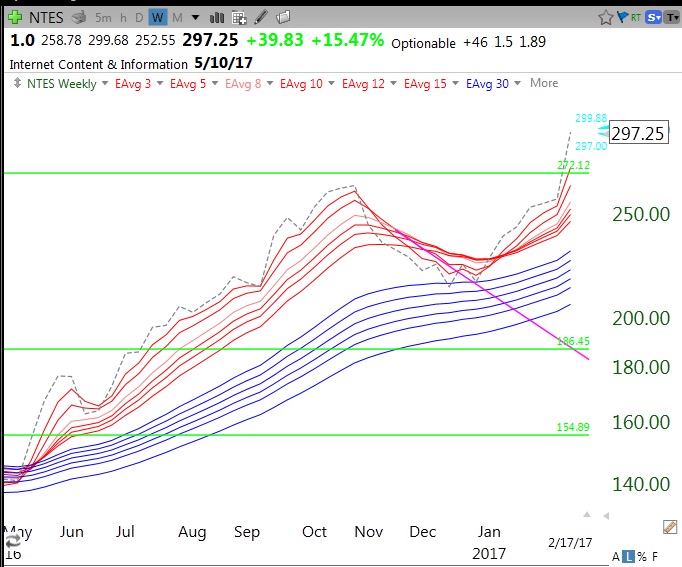

As did NTES.

Will AMZN be next?

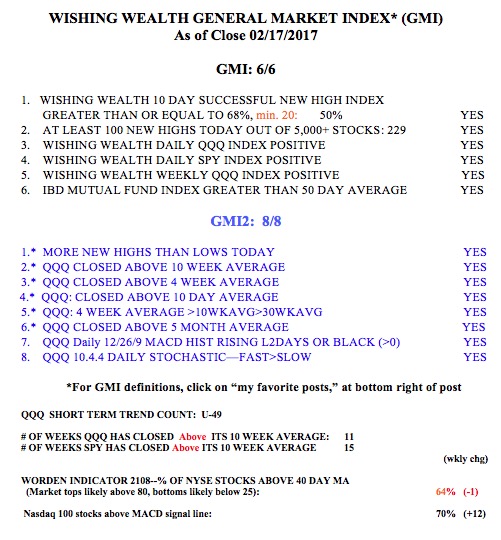

The GMI table: