I ran a scan (Scan: 11132016ATHweeklygainhivol available free at my TC2000 club) to look for stocks from my all-time high list that were up last week on above average weekly volume and then looked among them for those that had a GLB last week. Both PEN and DERM met these criteria. DERM has good recent earnings (+85%) but PEN does not (-233%). But PEN was an IPO in September 2015 and has more than doubled since its lows. So someone thinks it worthy of accumulating PEN. Note last week’s volume spikes in the weekly charts of each of these stocks. These stocks merit further research.

OLED had a GLB 2 weeks ago and looks very strong to me but may be too extended for me to buy right now. It is floating way above its 4 week average (red dotted line). I will wait patiently for an entry.

But SHOP had a GLB in the first week of January. I missed seeing my TC2000 alert and thought I had missed the break-out. I should have bought it on one of the subsequent bounces off of its rising 4 week average.

The weakening of the market leader NVDA,is perhaps flashing a warning of a tired bull. Note the heavy volume down weeks (red spikes) and that for 6 of the last 10 weeks NVDA closed down. Double top?

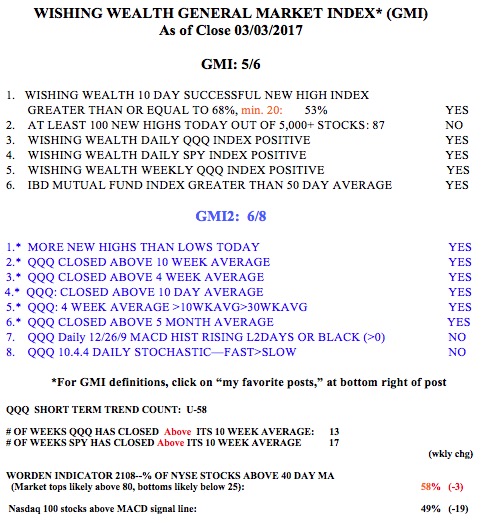

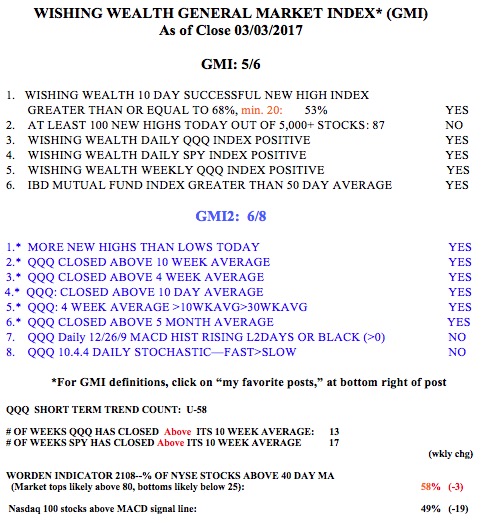

The GMI is at 5 (of 6), because there were fewer than 100 new highs (87) on Friday. The GMI-2 is at 6 (of 8) with its two most sensitive components having turned negative. I am concerned that the analysts do not appear to fear a rate hike in March. When the pundits start to think that the Fed’s raising rates does not matter, the market often contradicts them.

Last Thursday I presented a lecture before the local Society of Market Technicians. A gentleman came up to me and gave me a gift for my webmaster son in gratitude for his helping me to run this site. While I, unfortunately, did not take his name, my son sends his warmest thanks. SMT will be posting a recording of my talk for members on their site.