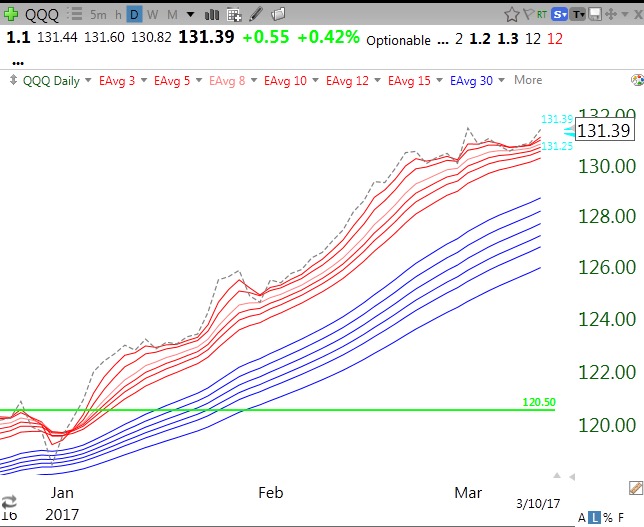

This daily Guppy chart of the QQQ shows that all 12 moving averages are lined up perfectly with the closing prices (gray dotted line) leading them all higher. Note the GLB to an all-time high in January. As long as the RWB pattern persists it is still time for me to be long growth stocks. If you want to see how following the GMI to trade QLD beats all other strategies this year, click here.

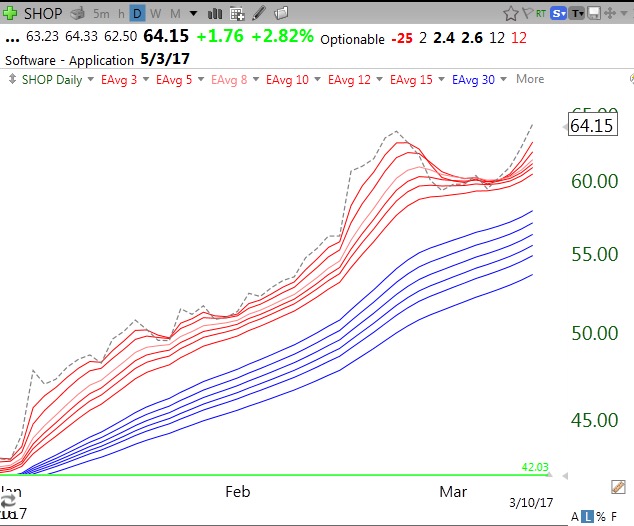

SHOP recently resumed its up-trend and so I jumped on.

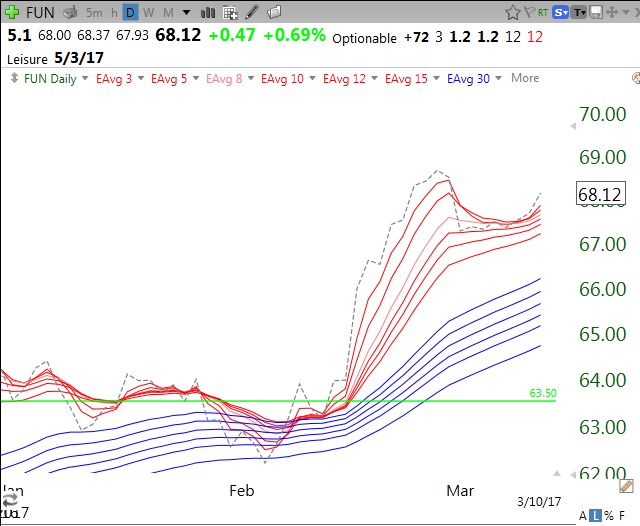

FUN may also be getting ready to resume its up-trend after consolidating post GLB.

And also WIX.

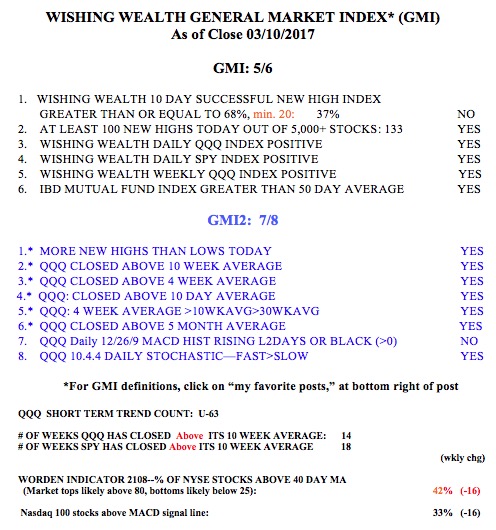

The GMI is back to 5 (of 6). The QQQ short term up-trend is now 63 days old.