Thus far, tech stocks, as measured by the ultra 3X ETF, TYH, are declining within the channel I have been watching for several weeks. The question, which my stock buddy, Judy, raised when I first posted the channel was, will the bottom of the channel hold as it has in the past? No one knows. The key for me is to wait for the reversal, and to then wade in slowly, with stops below the low of the bounce. Meanwhile, the Worden T2108 Indicator is now in neutral territory, at 58%. Only 19% of the NASDAQ 100 stocks have a MACD that is above its signal line, the lowest percentage since last November’s decline. The low in this indicator last November was 9%. The key for me is to remain defensive, and to cut losses before they grow too large.

3x ETF

GMI down to 2; Getting defensive

The market deteriorated very quickly last week. The 4 down days occurred on much higher volume than the single up day. In fact, the up volume of some of the bear 3X ETF’s (EDZ, FAZ, ERY) was the highest I have ever seen, especially on Friday. The 2X Ultra short QQQQ ETF (QID) also had huge up volume. This suggests that the pros are making huge bets on the short side. The Worden T2108 is now at 21%, not yet at extreme oversold levels, but it is getting there. The GMI fell

Ultra 3X ETF’s beat individual stocks again!

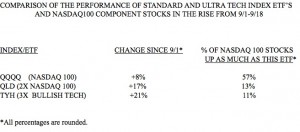

The table below, like the one I showed in late August, shows me the wisdom of forsaking individual stocks in favor of the 2X or 3X ETF”s. Why try to find the few stocks that can beat these ETF’s when the odds are so low? Since the current short bounce began September 1, the standard NASADQ 100 index ETF (QQQQ) rose 8%.  During this same period, the comparable Ultra 2X ETF (QLD) rose 17% and the tech 3x ETH (TYH) rose 21%. If I had been trying to pick the specific NASDAQ 100 stock that would outperform these ETF’s, I would only have had a little better than even chance (57%) of beating the QQQQ. But only 13% of the NASDAQ 100 stocks beat the QLD and 11% beat the TYH. So, why search for the low probability winning stock when I can just buy the Ultra ETF’s? Furthermore, a single stock can be slammed by bad news, but the ETF’s are less vulnerable to that because they represent an index or a collection of stocks. The key to trading profits is to play the odds and not to try to look smart by beating them….. Meanwhile, the GMI and GMI-R remain at their maximum

During this same period, the comparable Ultra 2X ETF (QLD) rose 17% and the tech 3x ETH (TYH) rose 21%. If I had been trying to pick the specific NASDAQ 100 stock that would outperform these ETF’s, I would only have had a little better than even chance (57%) of beating the QQQQ. But only 13% of the NASDAQ 100 stocks beat the QLD and 11% beat the TYH. So, why search for the low probability winning stock when I can just buy the Ultra ETF’s? Furthermore, a single stock can be slammed by bad news, but the ETF’s are less vulnerable to that because they represent an index or a collection of stocks. The key to trading profits is to play the odds and not to try to look smart by beating them….. Meanwhile, the GMI and GMI-R remain at their maximum