I have written before that an RWB pattern, where short term averages (red lines) are well above rising longer term averages (blue lines) such that there is a white space in between them, is typical of rocket stocks. I decided to create these modified GMMA charts for four time periods to get an idea of how the QQQ is likely to behave.

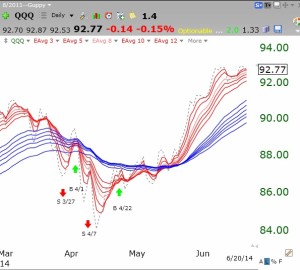

The first chart shows the longer term weekly chart, which is exhibiting a classic RWB pattern. It looks like the QQQ has emerged from a nice consolidation period where the red lines converged into a tight pattern (indicating little price change) well above the blue lines: (click on charts to enlarge)

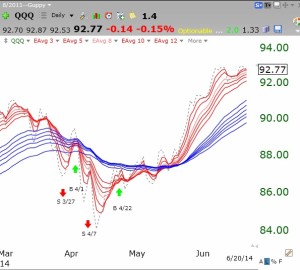

The daily chart shows a similar RWB pattern and the emergence of QQQ from a base at the end of May:

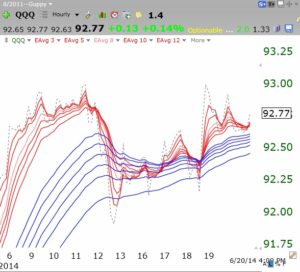

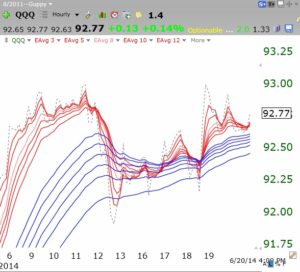

The hourly chart shows very recent congestion, but it looks like the red lines are back above the blue lines and are turning up. Thus the QQQ ended Friday with a small show of strength, but the QQQ needs to break the 93 level to come out of this short term consolidation.

The hourly chart shows very recent congestion, but it looks like the red lines are back above the blue lines and are turning up. Thus the QQQ ended Friday with a small show of strength, but the QQQ needs to break the 93 level to come out of this short term consolidation.

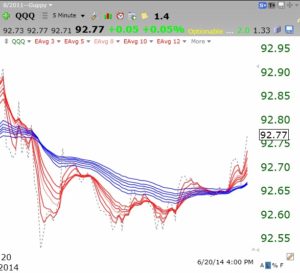

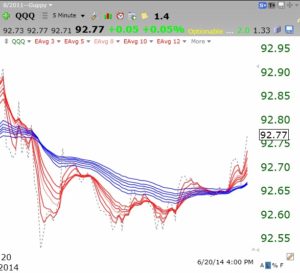

Finally, the 5 minute chart shows more clearly the end of day strength on Friday, with the red lines breaking above the blue lines in a RWB pattern.

Finally, the 5 minute chart shows more clearly the end of day strength on Friday, with the red lines breaking above the blue lines in a RWB pattern.

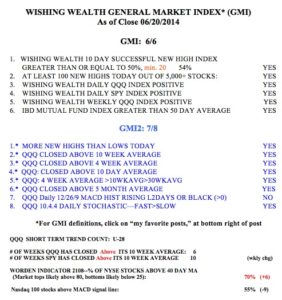

So what does all of this mean to me? Consistent with the GMI and its Buy signal from April 22nd, the market, as measured by QQQ, looks like it remains in a strong up-trend. As a longer term swing trader I focus on the weekly and daily charts. The hourly and 5 minute charts are useful only if I want to pinpoint areas for entries or where to put sell stops. I sometimes have TC2000 send me an automatic email alert when the price of the index I am following crosses below or above one of these key moving averages…..

By the way, my stock buddy, Judy, alerted me to a new drug stock she is excited about and I bought a small number of shares. (Judy had bought the stock much lower because if she likes a concept she is willing to buy early and wait for a rise.) It may be worth researching this very speculative stock, PTLA, especially if it can break above its green line top, around $31. PTLA is developing some promising new drugs. Here is PTLA’s weekly chart. I think it to be an important technical signal when a recent IPO forms a multi-month base and then breaks to a new all-time high. I am watching PTLA very closely for signs of a high volume break-out above 31.

I also took a small position last week in STZ, as it broke out of a cup and handle consolidation on high volume. Check out this weekly chart.

If you are interested in learning more about my strategies for tracking the market, you may want to attend the July AAII work shop that Alan Ellman and I are presenting in Virginia on July 19. Alan is very skilled at teaching people how to sell covered call options on their stocks to earn income. He makes the process relatively easy to understand. For those of you who cringe at the mention of the word “options,” you need to know that writing covered calls is considered a very conservative way to use options. Anyone who keeps a portfolio of stocks and does not sell covered calls on them is potentially missing an opportunity to earn $$$ from their stocks at the same time as they lower potential losses if their stock declines. Check out Allan’s books on the lower right of this page. I hope to see many of you there. Here is the link to register for the meeting……

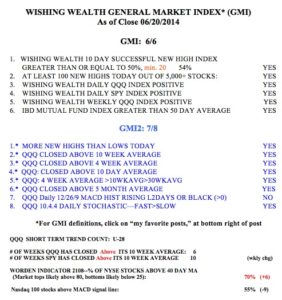

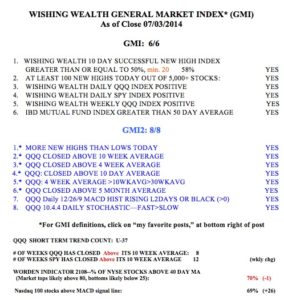

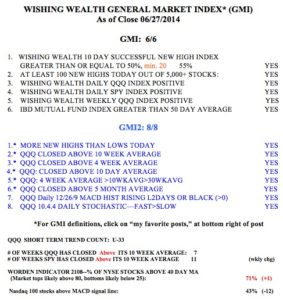

And here is the weekly GMI table. Let me know if you find any errors, Rick 🙂