The GMI is back to 6 (of 6). I have to “fly by instrument” and stay invested long in spite of my emotions from the news. My university pension has remained 100% invested in mutual funds. My trading accounts are now holding long positions. (Long means I am expecting the equity to rise.)

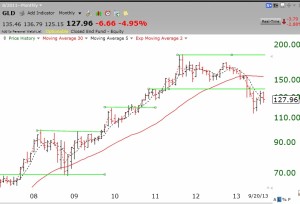

I did a lot of work the past few days looking for green line break-outs.Check out my TC2000 webinar from December 2012, link posted to the right of my blog page. for an explanation of my green line strategy. I like to buy green line break-outs and to place my sell stop somewhere below the green line. A lot of stocks break above the green line and then re-test it before resuming their advance. Because one never knows if the advance will resume, I sell when the stock closes below the green line and may buy back if it rises above it again. In an IRA, I am not concerned with wash sales tax rules. Here are a few weekly charts of stocks that broke above their green line tops last week or the prior week and had recent earnings up at least 100%. These stocks (TPLM, URI, EEFT, GENT) are well worth researching.

FB has continued to rise after its green line break-out. (I own it.) Ignore the annotations from my class.

Lest you think that buying at a green line break-out is too late, feast your eyes on FLT. You may also want to see what TSLA has done since breaking its green line last April around $40. Of course not all green line break-outs perform this way. The challenge is to ride those that do and quickly abandon those that do not.

Click on charts to enlarge.