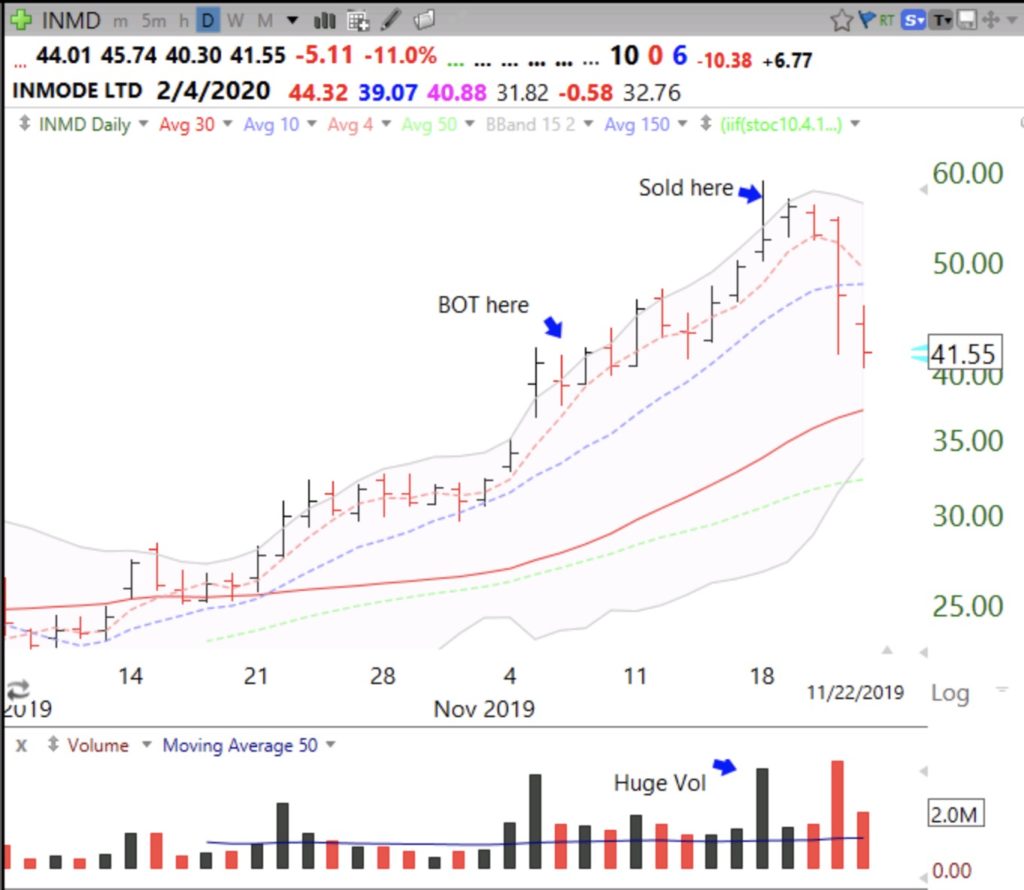

During the internet bull market of the 90s I sold Yahoo around $400 per share (pre -split) because my internal voice said making money was too easy. I had seen the stock go up $50 in one week when I was holding a large position. I tell my students that whenever my voice cautions me that way, I sell. (It rarely happens!) It happened a few days ago, however, when I had a small position in INMD. I watched it rising fast and then on Monday morning, 11/18, INMD was trading up almost $9 from Friday’s close. It was also trading outside of its upper daily 15.2 Bollinger Band on very heavy volume and had gone vertical. My voice went off and I sold around $57. I had a 40%+ gain in just 9 days. I was lucky. INMD closed Friday at $41.55. When I make money too fast, I sell. As they say,: Bulls make money, Bears make money and Pigs get slaughtered. (Wy did I buy this stock? The consummate trader, Mark Minervini, @Marmminervini, had tweeted about INMD.The stock was a strong recent IPO and at all-time highs. I merely bought some on November 6, with the intention to sell it if it traded lower than the prior day’s low. I get great trade-able ideas by following the tweets of a couple of very smart traders: @markminervini and @TMLTrader, whom I met at Mark’s annual invaluable trader workshop.

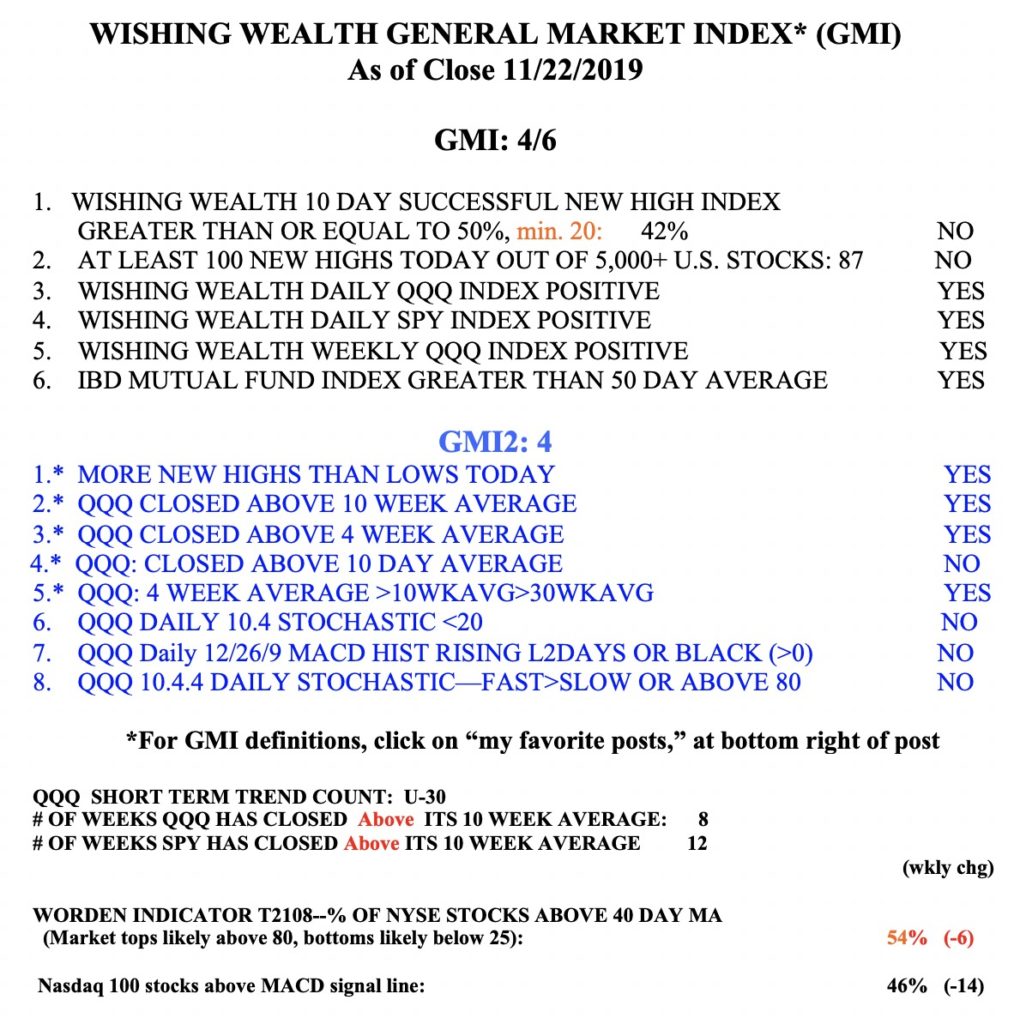

The GMI is at 4 (of 6) and many of the very short term indicators in the GMI2 are negative. This is a reduced trading week and probably not the time for me to add or increase positions.