Market is getting very oversold. T2108 is at 27%, 598 daily new lows, 62% of stocks with an oversold 10.4 stochastic, GMI and GMI-2 both= 1. And yet the longer term trend of the market is still up, in a Weinstein Stage 2 up-trend. Based on my 45+ years of trading experience I think the market has further to decline. So many people have come to believe that the market only rises, based on the past 5 years of gains. When the new year starts many may be willing to sell and take their gains in the new tax year. And then there are all of the retiring boomers who will panic from the fear of their imminently needed retirement savings diminishing. I just remember a lot of significant market tops occurring in January…….

Tuesday was the second day of the new $QQQ short term down-trend. I own mainly SQQQ and will accumulate more if this decline lasts 5 days. Since 2006, about 40% of short term down-trends (the way I define them) have lasted 5 days or less. Once one passes 5 days, it often goes a lot further. I remain largely in cash in my trading accounts. If I could frequently trade my mutual funds in my university pension, I would have transferred some money to money market funds. We need to be super cautious and to read what Mr. Market is telling us about his likely direction.

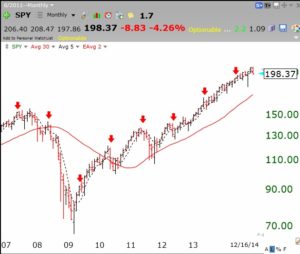

This monthly chart of the SPY shows that the current decline hardly registers. This could mean that the current decline will be tiny or that it is yet to begin…. (red arrows show month of May to track the sell in May signal)