As a tribute to the Thanksgiving Holiday, I thought I would share with my readers the trading philosophy I have developed over the years. It is based on my 40+ years of experience in the market and the insights achieved from my voracious reading about the market during that period. My philosophy is based on my interpretation of such great market seers as Darvas, Weinstein, O’Neil, The Turtles, and of course, the greatest trader, Jesse Livermore. (The books written by or about these persons appear in the lower section of my blog). Anyway, I hope you find these propositions useful and would value your additions and comments. A version of these remarks was published under the pseudonym Sir Silent Knight, as part of the Worden TC2007 daily journal.

Dr. Wish’s (Sir Silent Knight’s) Trading Philosophy

Proposition 1. The stock market and stocks are unpredictable

No one can consistently predict changes in the market or stocks. Human behavior is largely unpredictable and no one can predict world and economic events or the reactions to them. Similarly, corporate events and news can be inaccurate or intentionally misleading.

Proposition 2. However, stocks and markets often continue in trends that can last weeks or months or longer.

Trends form identifiable patterns, probably because humans react to trend patterns in repeatable ways. For example, people often trade off of support or resistance levels or at new highs or lows. While trends can be discerned once started, their length and continuation are also unpredictable.

Proposition 3. Given Propositions 1 and 2, one’s success in the market depends on identifying trends once they have begun and staying with them until they end.

But if the length and size of trends are unpredictable, each trade may or may not work out; the likelihood that any given trade will be profitable is unknown. Some successful traders have asserted that only about 50% of their trades are profitable.

Proposition 4. If only 50% of trades will be profitable, then to prosper, the profits from winning trades must be considerably larger than the losses from losing trades.

One can accomplish this goal by limiting the losses on losing trades and by maximizing the profits on winning trades. One can limit losses by setting stop losses and by making small initial trades. One can increase profits by riding the trend as long as possible AND by systematically increasing one’s position as the trend continues.

Proposition 5. Given Propositions 1-4, trading success is mostly determined by one’s strategy for exiting the trade rather than the strategy for entry.

Since one does not know at entry whether a trade will be profitable, one could probably select stocks at random as long as losses are kept at a minimum and profits are maximized. However, systematic entry and exit rules based on technical analysis can improve the likelihood of a profitable trade. For example, most stocks follow the general market’s trend, and trading consistent with that trend can enhance one’s likelihood of success. Nevertheless, given the considerable uncertainty accompanying all trades, the highest priority must be given to the rules for exiting the trade. If one enters each trade assuming that it will fail, one will be better prepared to handle losses.

It is the trader’s job to use technical analysis to develop trading rules that function consistent with these propositions. My blog, wishingwealthblog.com, documents my pursuit of this goal.

Happy Thanksgiving!

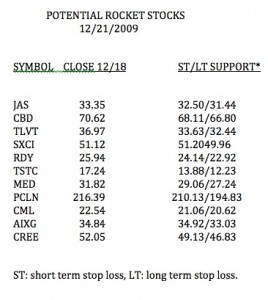

All of these stocks had last quarterly earnings up at least 100%. Coincidentally, all but 4 of the 11 are in my records as having appeared on the IBD100 and/or IBD New America lists during the past year. I have also noted in this table where I might place long term or short term stop losses on each long position. The most conservative stop loss is the short term support level. With a growth stock I rarely retain a long position if the stock closes below its short term support level. However, if I bought near long term support I might use the LT support level as my exit strategy. I will return to these 11 stocks in a future post to show you how they behaved. These stocks have already proven themselves as being in strong up-trends, but one never knows when an up-trend will end. That is why I immediately enter a sell stop or buy a put option for insurance, after buying one of these high momentum stocks. I currently own 3 of these stocks.

All of these stocks had last quarterly earnings up at least 100%. Coincidentally, all but 4 of the 11 are in my records as having appeared on the IBD100 and/or IBD New America lists during the past year. I have also noted in this table where I might place long term or short term stop losses on each long position. The most conservative stop loss is the short term support level. With a growth stock I rarely retain a long position if the stock closes below its short term support level. However, if I bought near long term support I might use the LT support level as my exit strategy. I will return to these 11 stocks in a future post to show you how they behaved. These stocks have already proven themselves as being in strong up-trends, but one never knows when an up-trend will end. That is why I immediately enter a sell stop or buy a put option for insurance, after buying one of these high momentum stocks. I currently own 3 of these stocks.