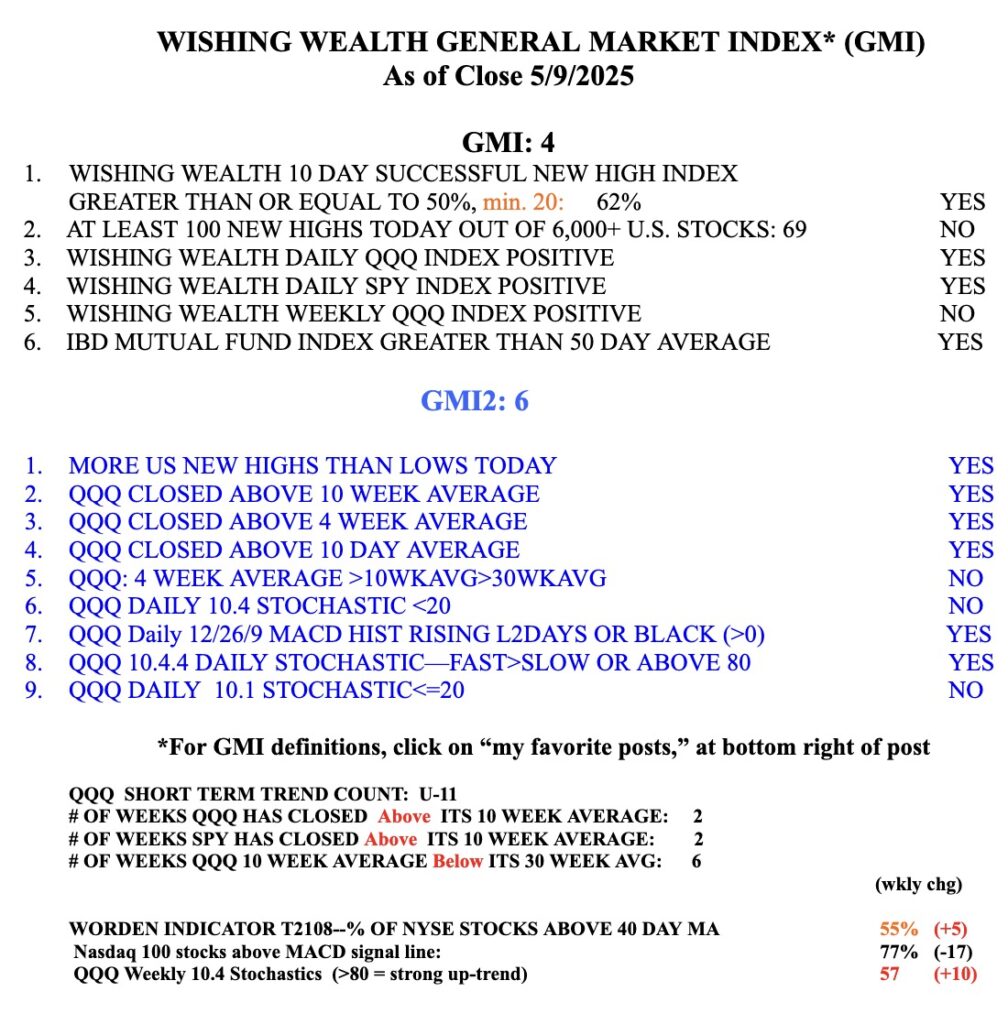

The massive market rise on Monday puts QQQ above its 30 week average. Now the GMI= 6 (of 6). We need to see if it can hold. In the meantime, look at UBER, which retook its green line and closed at an ATH on above average volume. See daily and weekly charts. Must not close below its green line at 81.86.