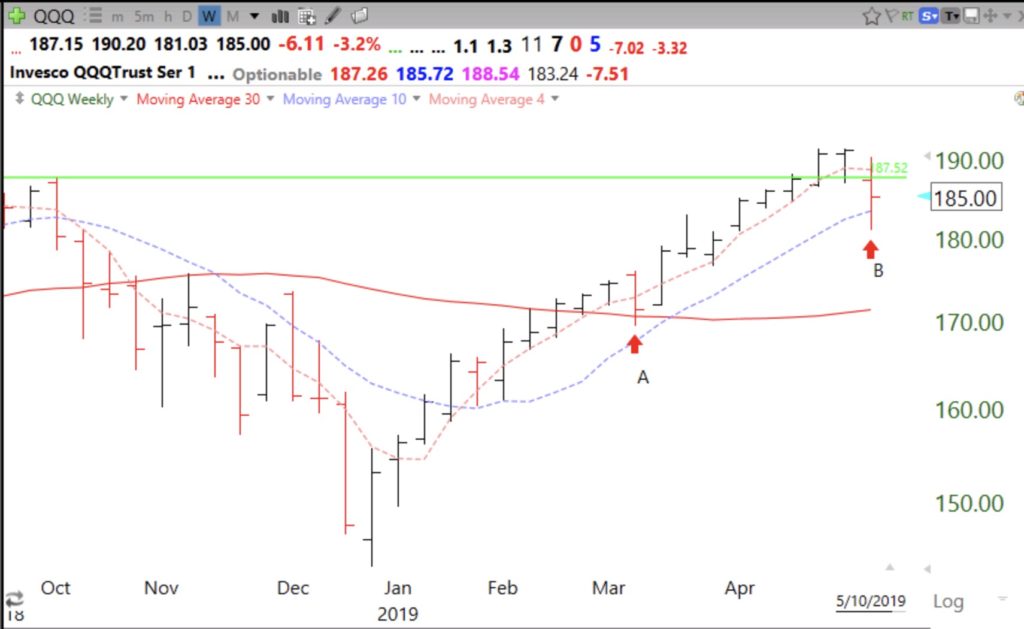

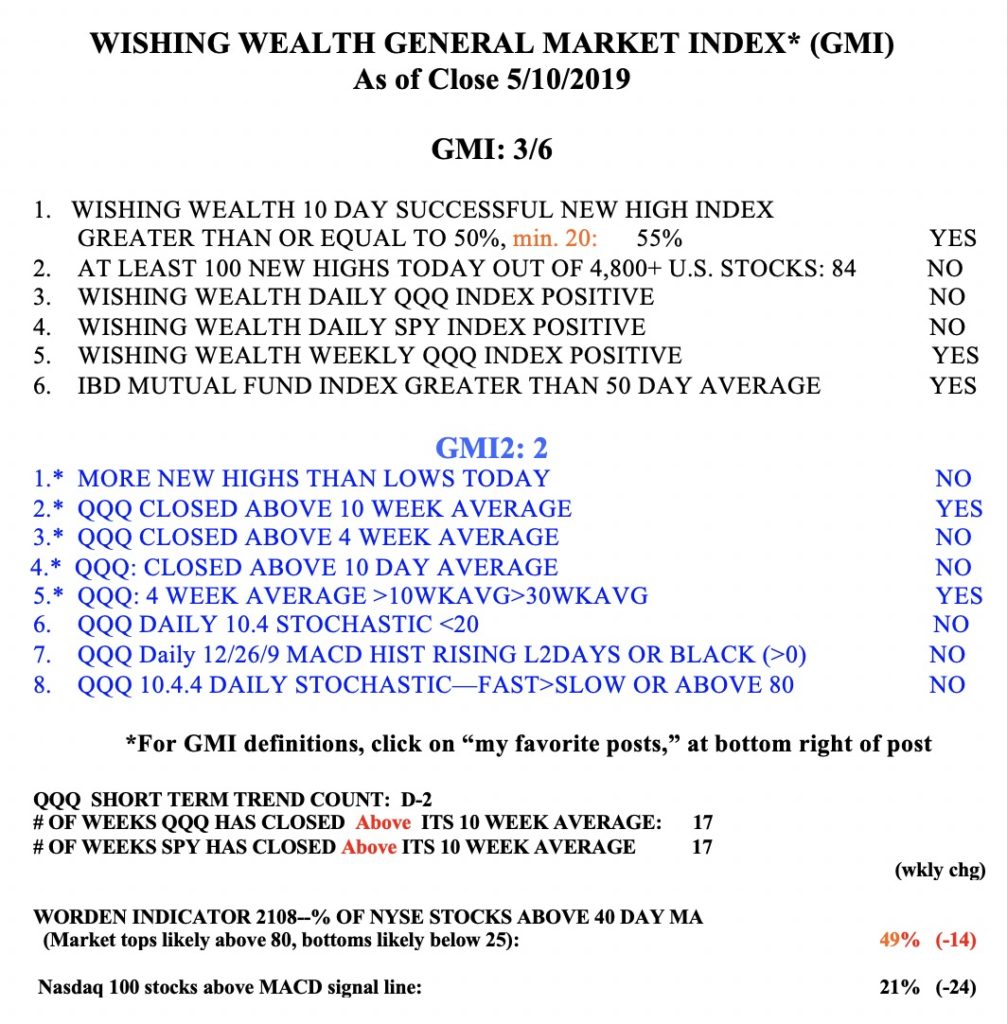

To survive, I must conserve my trading capital. My trading accounts are therefore in cash. The GMI may flash Red at the close on Tuesday. It is much easier to make money on the long side when the GMI is strong and Green. GMI= my General Market Index. The GMI keeps me trading with the market trend. Unfortunately, once again, I failed to buy a little SQQQ on the first day of the QQQ short term down-trend. QQQ is now below its 10 week moving average (purple dotted line on this weekly chart). Note the failed GLB (green line break-out), a major sign of weakness.

Meanwhile, T2108 is only at 36%, not low enough for a major bottom.