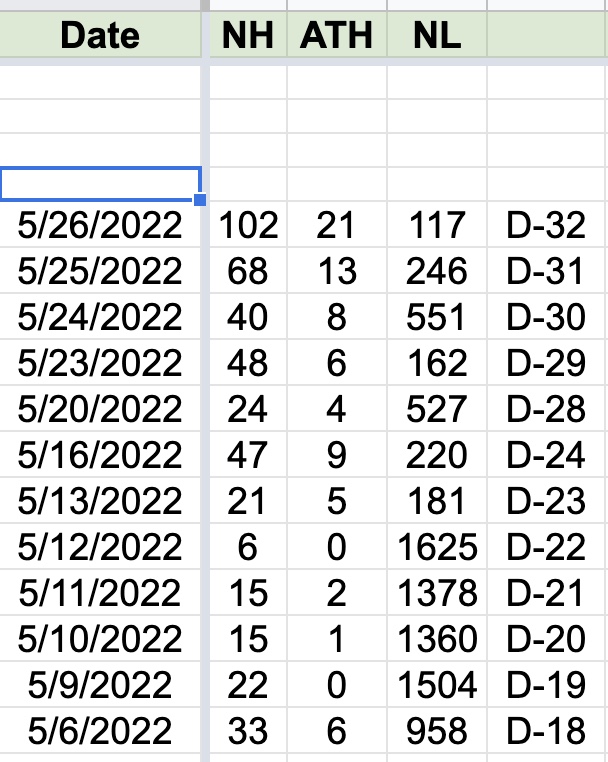

On May 9-12, between 1360-1625 of US stocks reached the lowest price they had traded in the past 250 days. From May 13-26, even though the indexes declined further, no day had more than 551 new lows. This meant that while the indexes declined to new lows, fewer stocks did. This is the reverse of what we had in November when the indexes were hitting highs but the number of new highs was declining and new lows were climbing, which alerted me to exit the market. Tracking the number of new lows and highs may be a worthwhile activity for gauging the market’s strength. This strategy is somewhat different than just calculating the difference between yearly highs and lows. I use TC2000 to count and record the number of new highs and lows after each day’s close. ATH=all-time high and the last column is my QQQ short term trend count. Having 100 or more new highs in a day is one of 6 components in my GMI (general market index) and explains why it increased to 1 ( of 6) today.

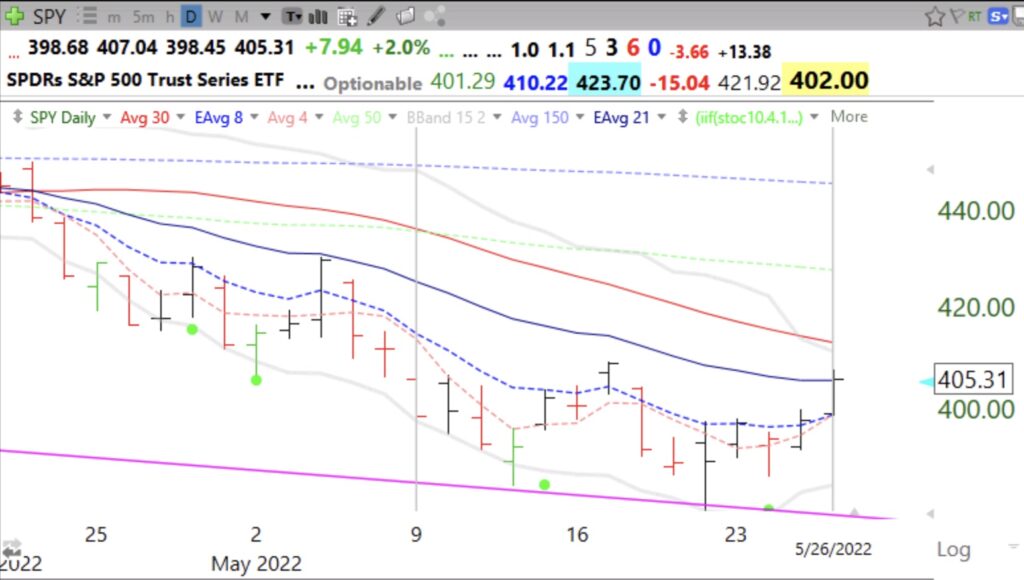

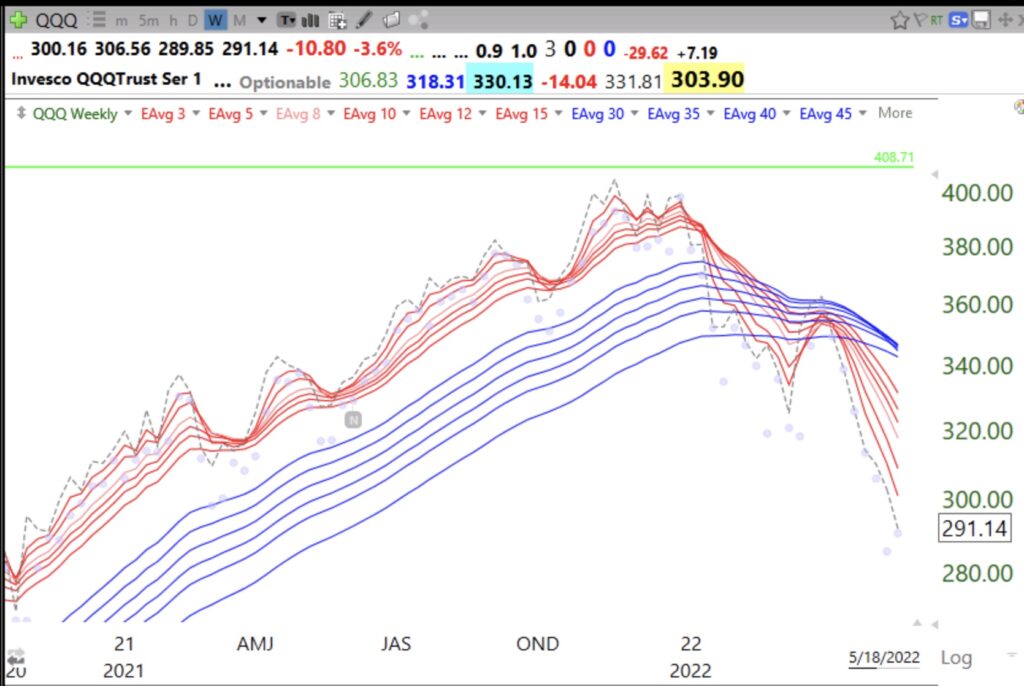

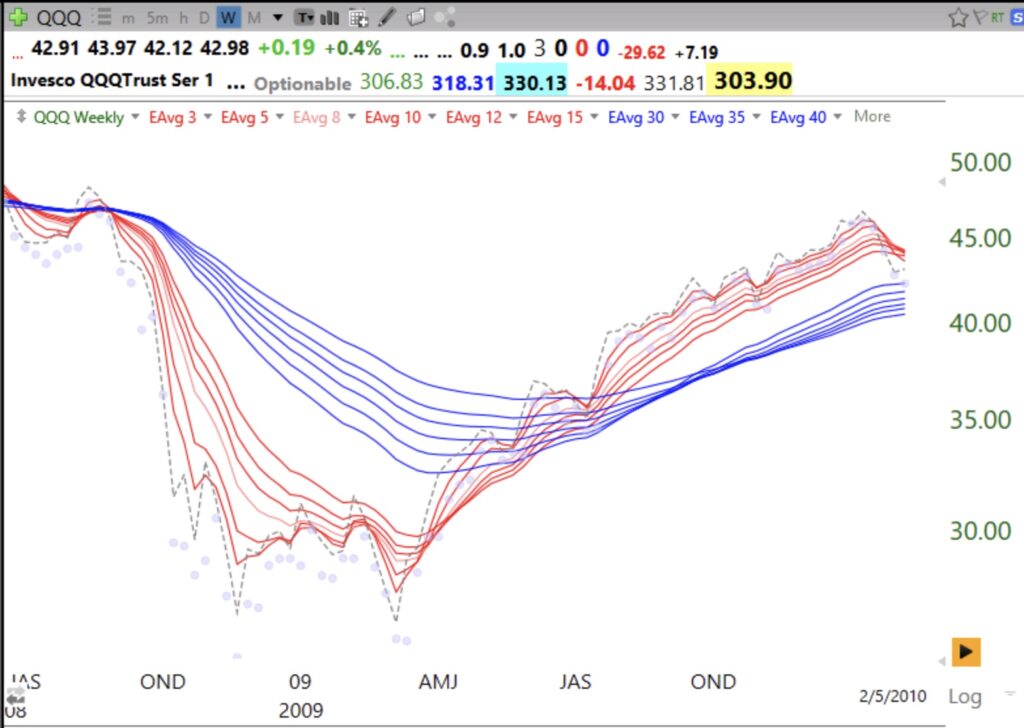

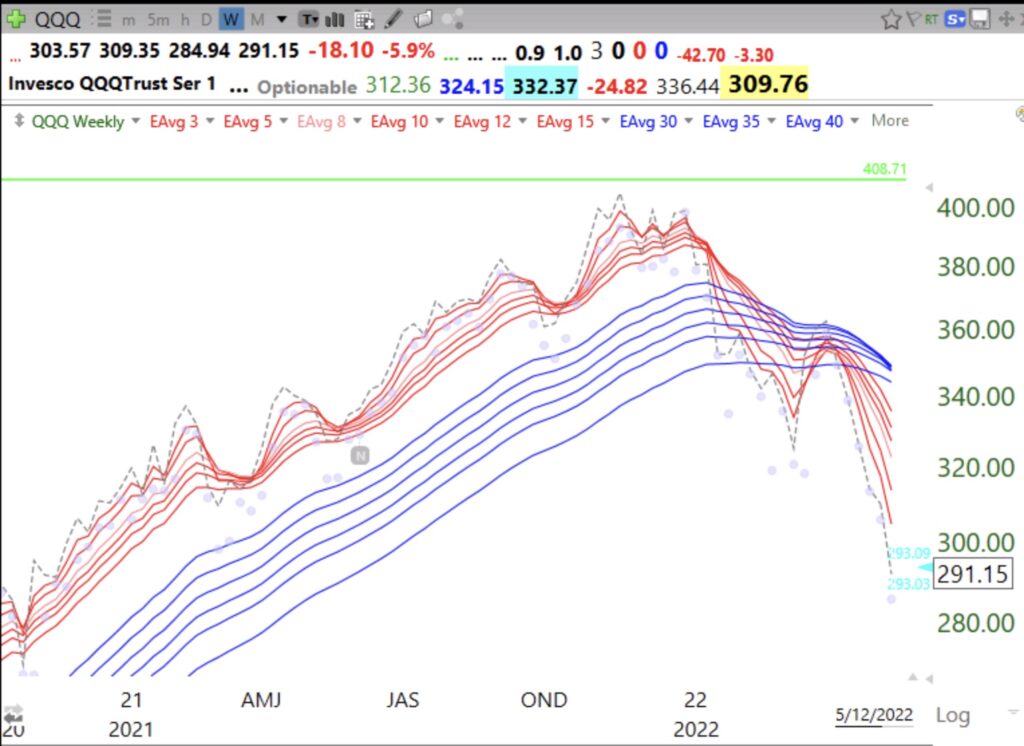

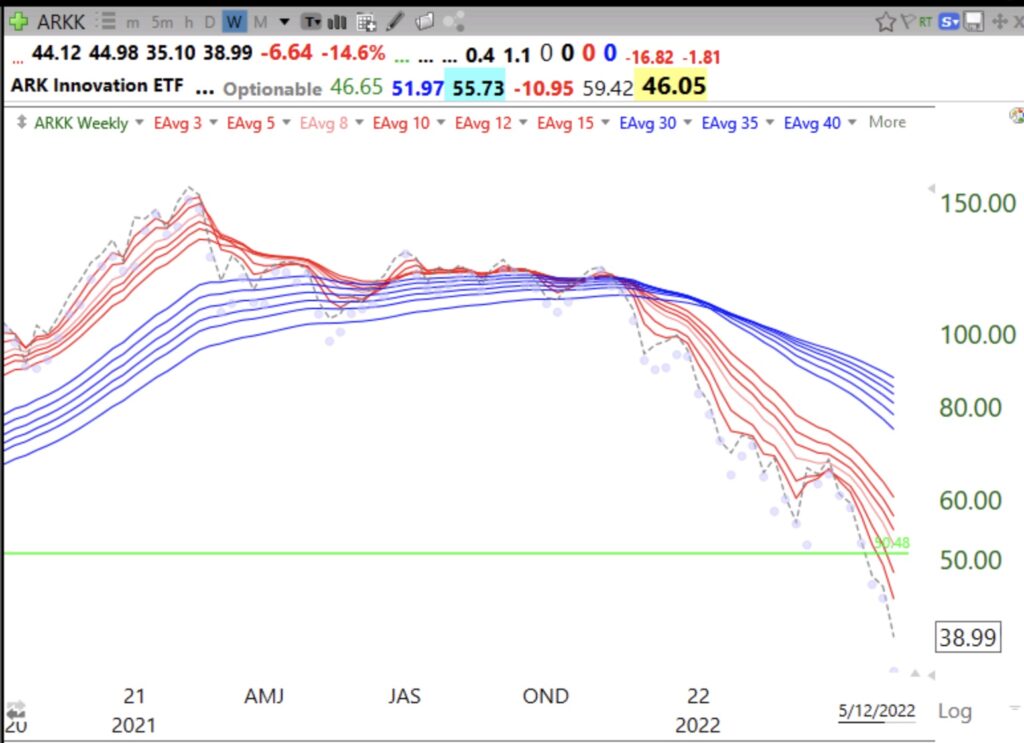

See how QQQ and SPY traded during this period.