All of the stocks in this table are at all-time-highs except RCMT which hit 35.65 in August, 1989. In looking over the stocks that Darvas and O’Neil made a lot of money on, I saw that they were breaking out of bases to an all time high (ATH). A lot of traders on social media are looking at stocks in bases that are far below their ATH. I think this is a mistake. The biggest winners advance to an ATH, form a base and then break out to a new ATH. Look at the webinars I post on my blog to see examples. I draw a green horizontal line on a monthly chart at the top bar that has not been exceeded for at least 3 subsequent bars (3 months). Think of them as rockets resting for at least 3 months. I like to buy stocks when they close above their green line and if I miss the break-out, I only buy stocks trading above their last green line when they bounce off of support. In 2009 after the huge market decline I found GMCR, a big winner, when it broke to an ATH. See the post I wrote then. GMCR was the developer of the Keurig coffee machine= N in CAN SLIM. See its monthly chart.

While we do not know if the market has bottomed, it is noteworthy that a handful of stocks came through this decline and still reached an ATH on Friday. Instead of looking at the fallen angels, I look for the new leaders. I have a filter in TC2000 that shows me all stocks in my IBD/MarketSmith watchlist that reached an ATH during the day. On Friday there were 14 stocks out of 782. My watchlist contains stocks mentioned by these services in the past few months. The list below is sorted by close/close 250 days ago. Darvas liked to buy stocks that had already doubled from a year earlier. David Ryan said that he likes to buy doublers too. Thus, RCMT is 7.41 times its close a year ago. Nine of the 14 stocks come from the oil and gas sectors. Maybe that is where I should be focusing my attention? Note that one of these stocks has a null result for the division by its price a year ago. This means it is a recent IPO. I posted its chart below. Nice IPO base break-out for $SLVM! The first green line break-out (GLB) failed, however. If I buy a GLB I sell if the stock closes below the green line. If it fails I often repurchase it upon the next GLB.

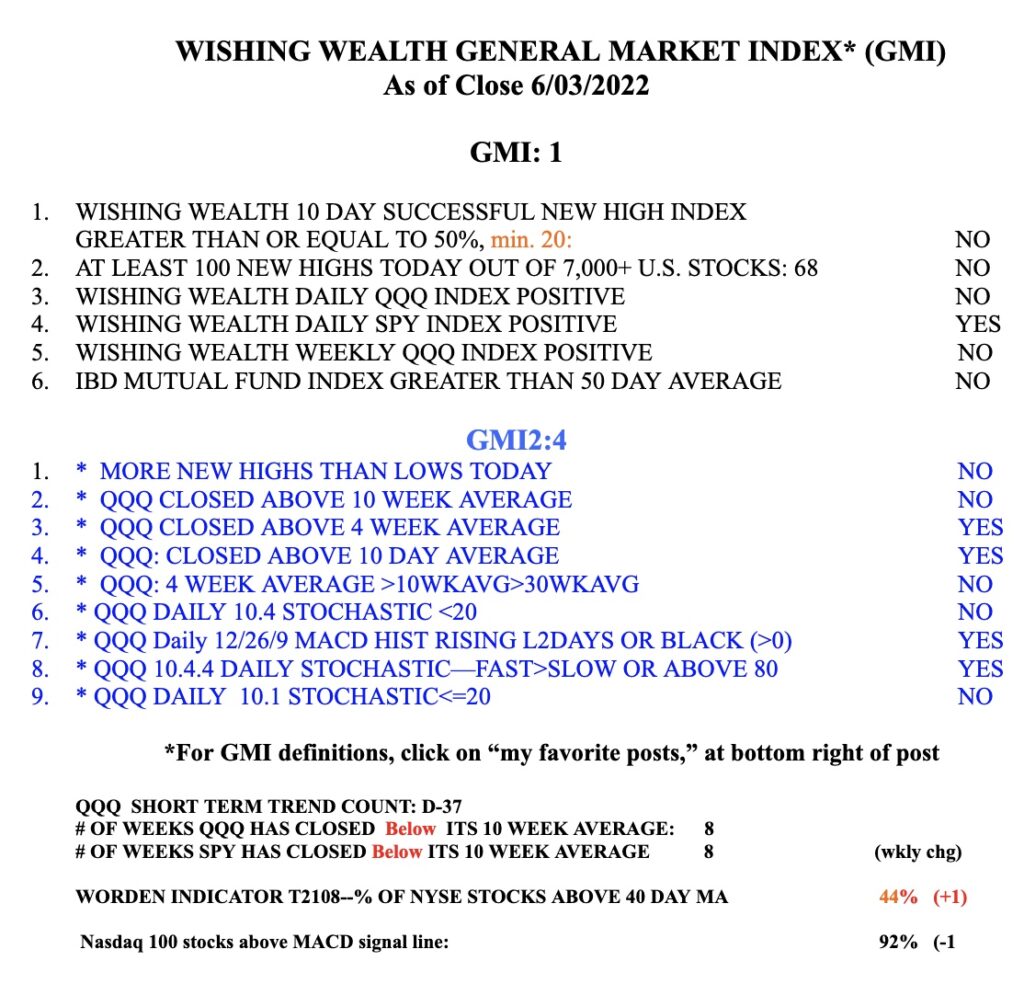

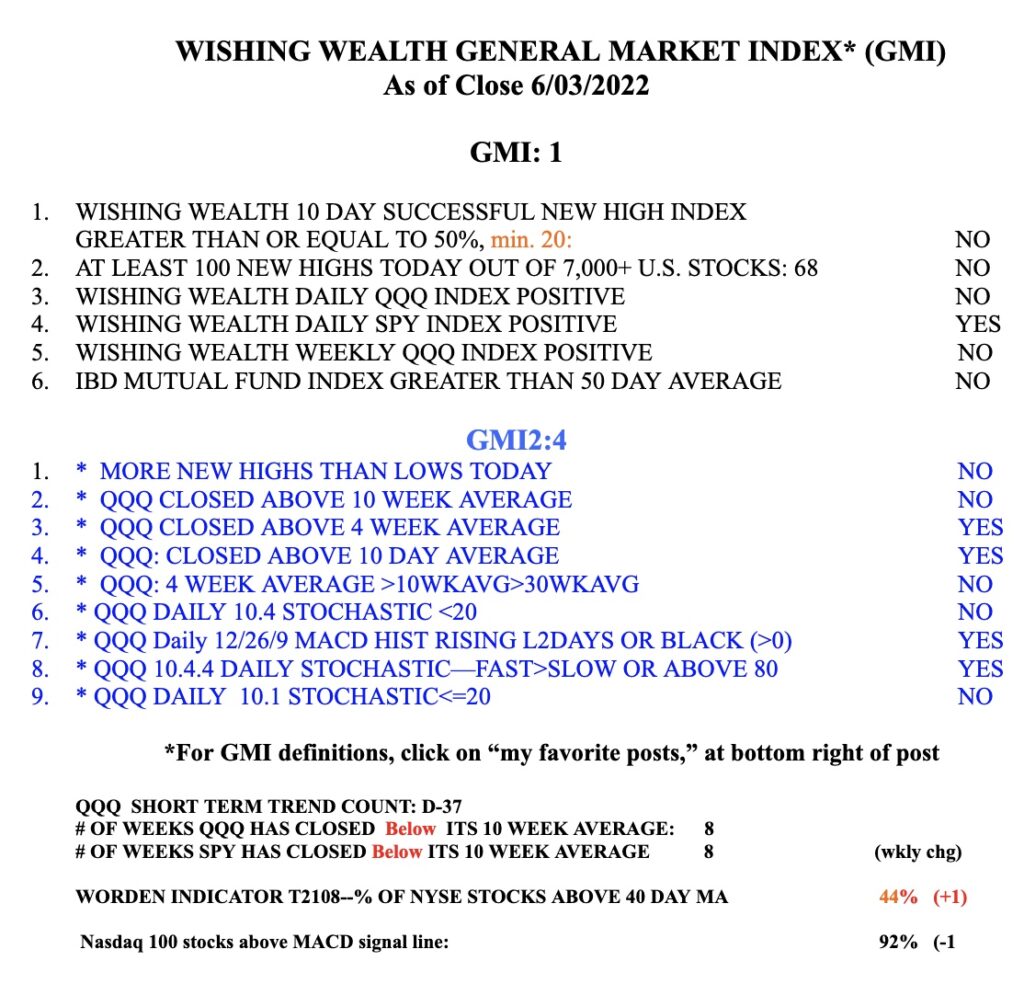

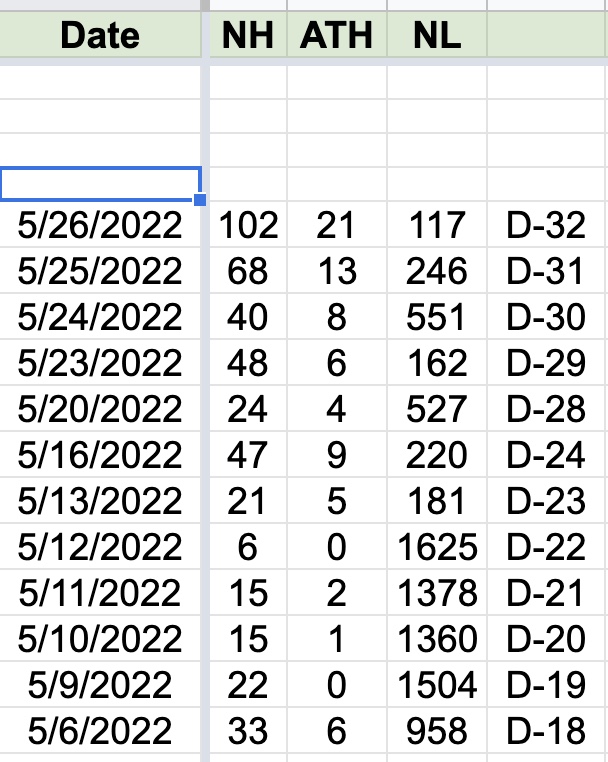

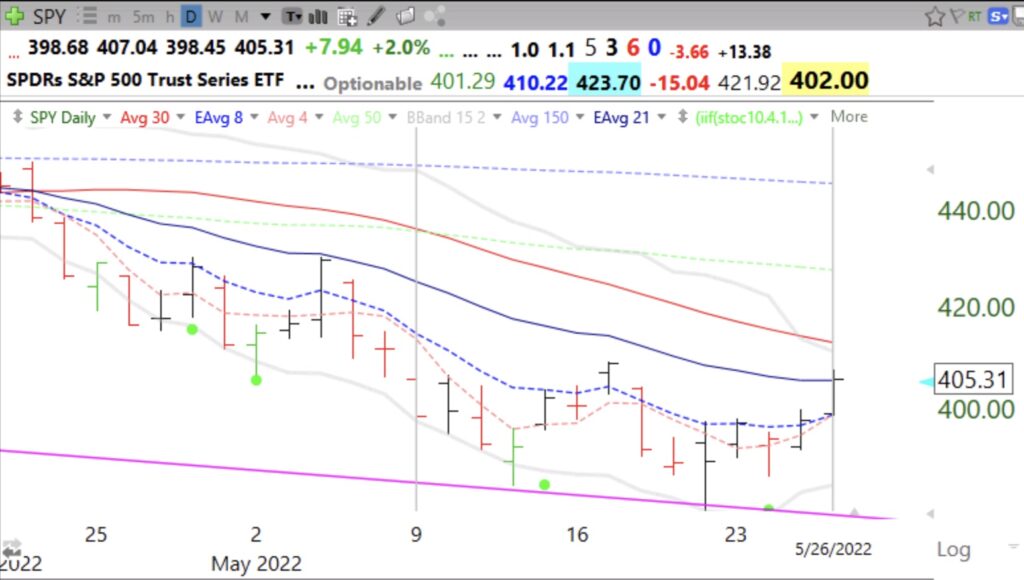

The GMI is still weak at 1 (of 6) and the QQQ short term down-trend remains intact. I remain in cash since November in my pension accounts but have nibbled at some of the stocks in this table in my trading account. Do not marry a market scenario. Most say the market did not enter a panic mode and must do so to really bottom. I also would be more confident of a bottom if T2108 had fallen further. However, it did reach 9.19% on May 13. I am prepared to enter stocks again in my pension accounts only when the longer term trend changes to up. Contrary to popular wisdom, it s not necessary to stay in the market or to try to get in right at the bottom. There is plenty of time for conservative swing traders, investors and retirees to make money when the longer term trends turn up. I prefer to leave the market volatility and considerable risk to the day traders who are glued to their monitors. Livermore, Darvas and O’Neil made big profits by holding on for the big swings.

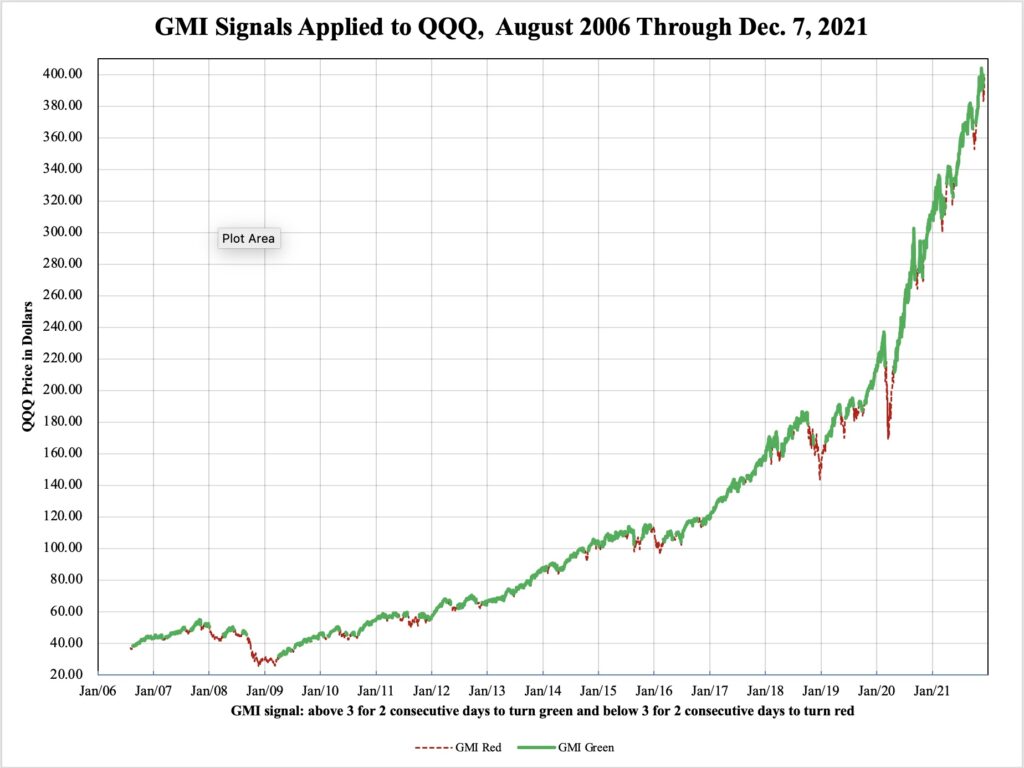

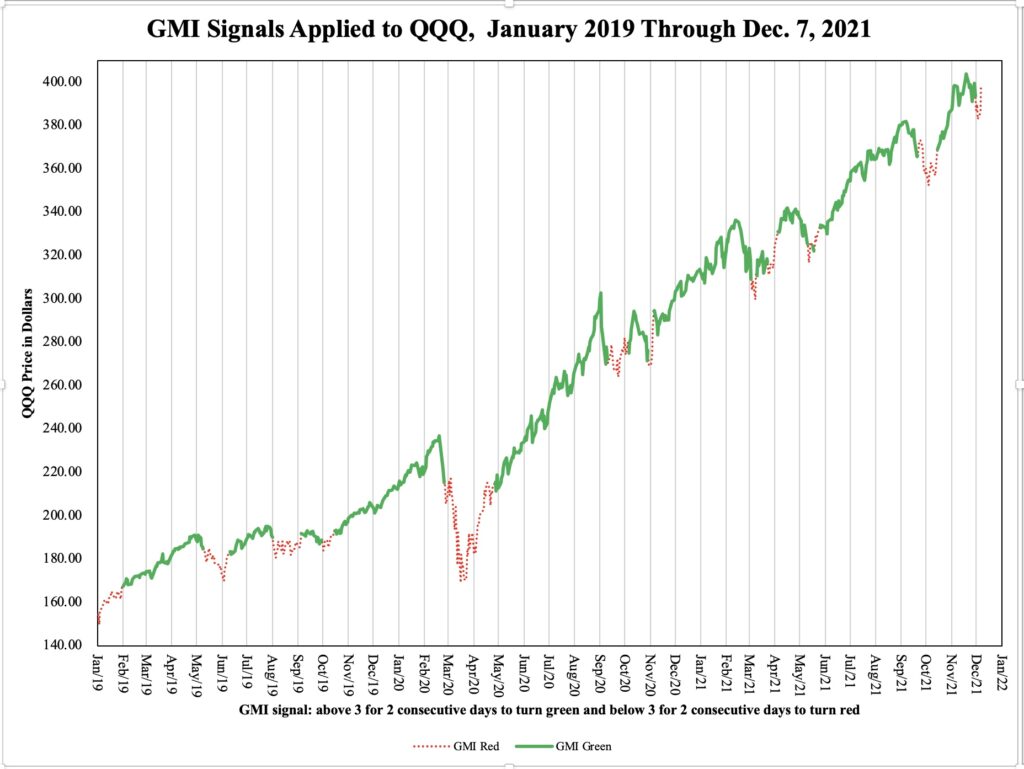

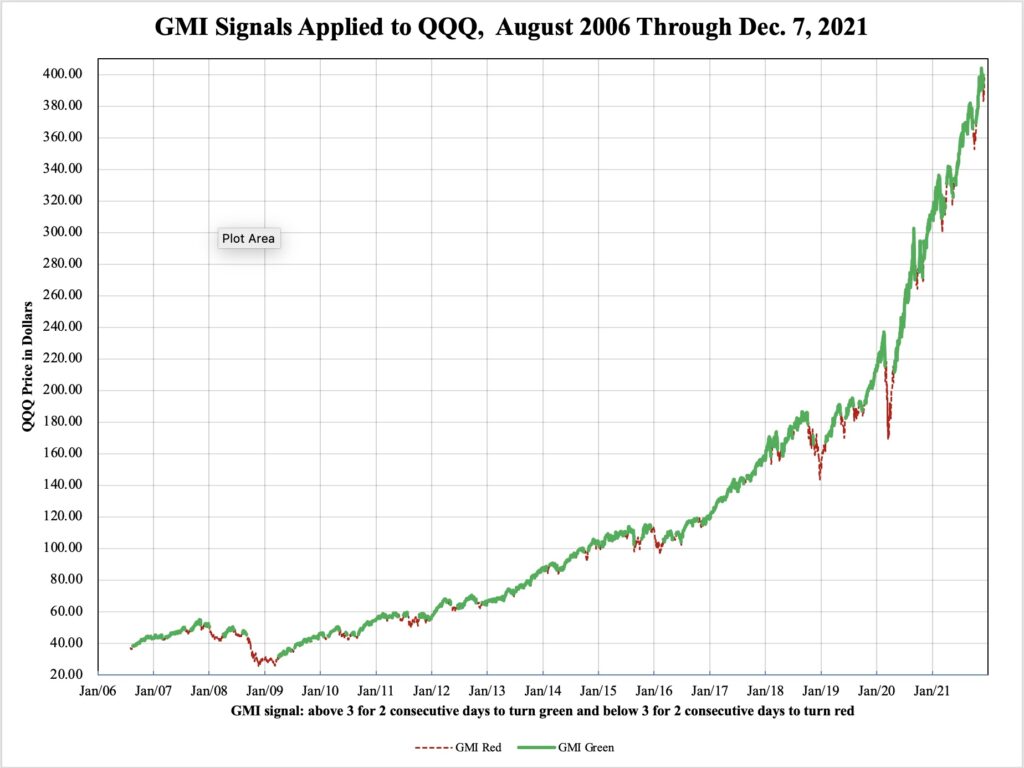

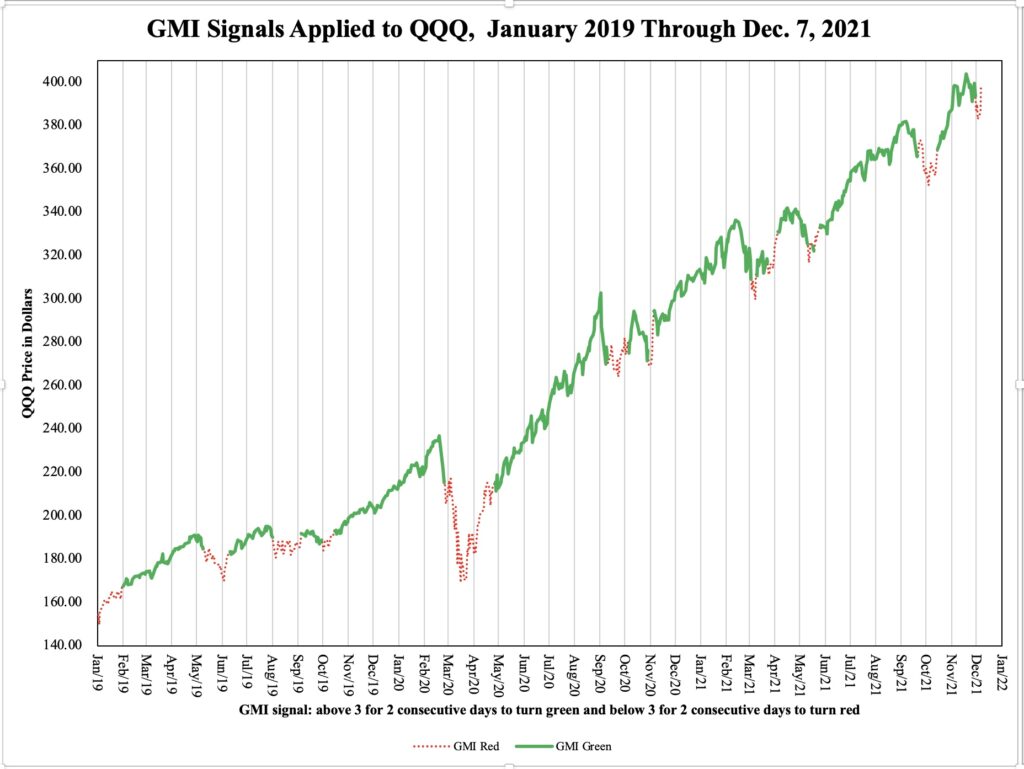

The GMI remains on a Red signal. It is so much easier to make $$$ when the GMI is Green and registering 5 or 6. These charts show QQQ during the GMI’s red and green signals. The GMI has been Red since April 12.