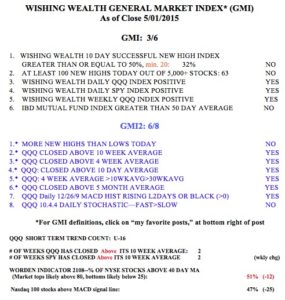

My market indicators are quickly deteriorating. QQQ sold off on large volume and re-entered its channel. I am getting very defensive.

One of my only holdings is TASR, which has broken its green line top from December 2004. TASR hit a new all-time high on Tuesday. A lot of police are going to be wearing their cameras. My stock buddy Judy has been talking about TASR for quite a while. Having gone vertical, it may be extended.