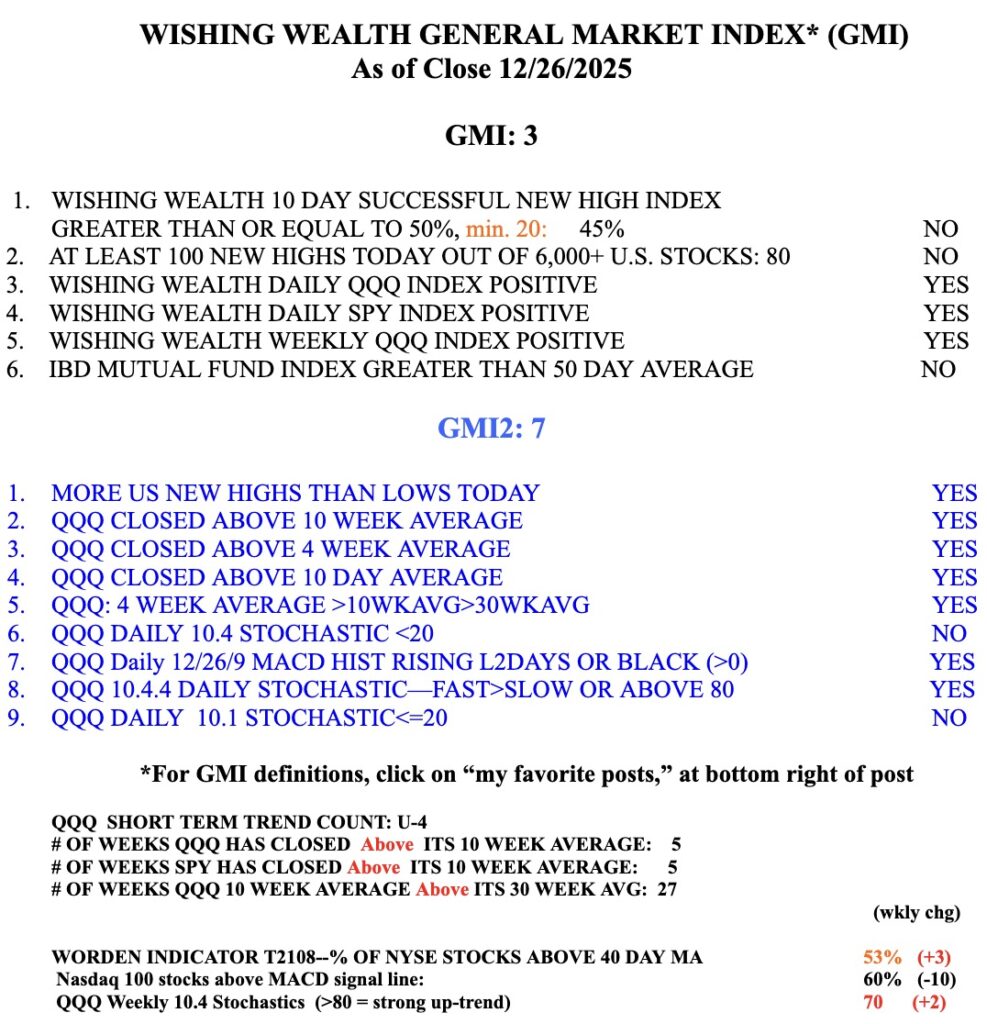

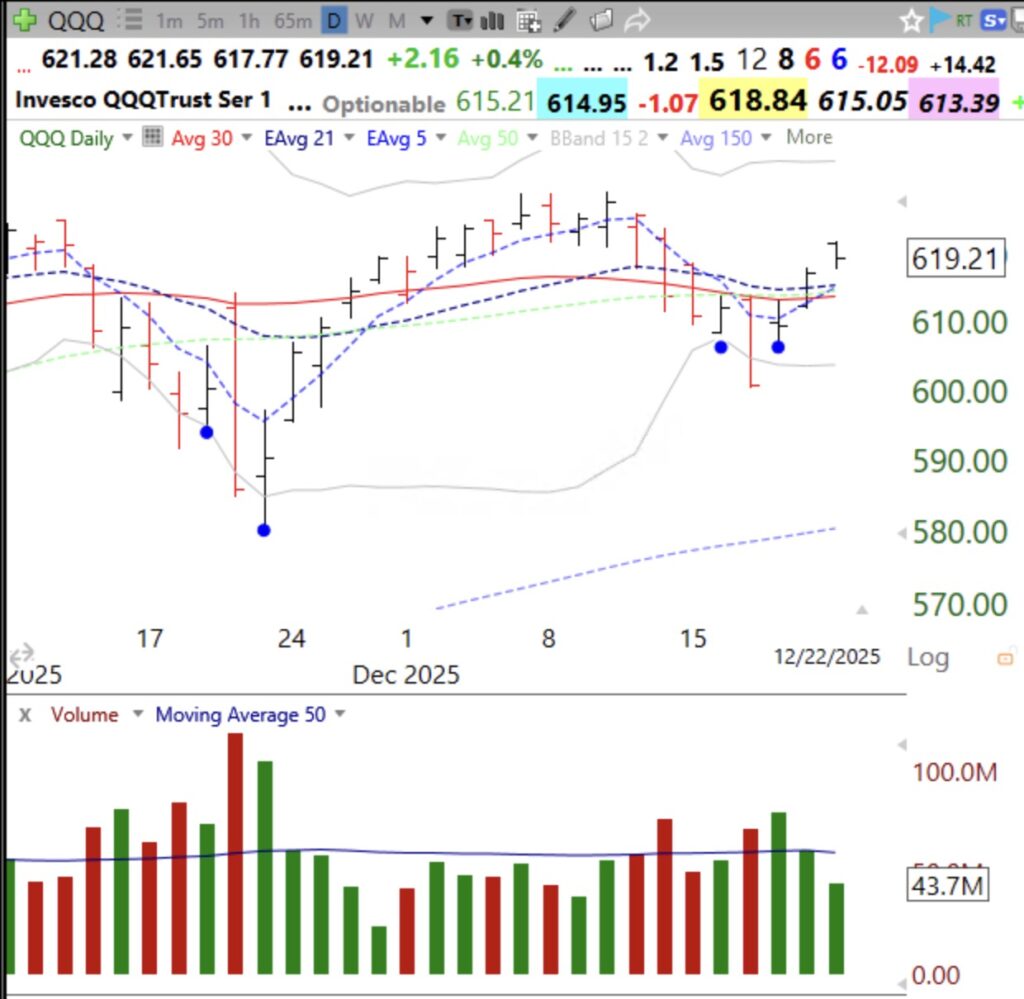

So many things are not adding up. Not many highs or ATHs and long treasury bonds are declining, see chart below. I own a very little SQQQ in case a new QQQ short term down-trend begins on Friday. It is late and I had not planned to post tonight. I just want to tell my readers that I have gone to cash and hope that I am wrong and a good contrarian indicator. The GMI2 has fallen to 2, indicating that my most sensitive short term indicators are now negative. Below is a daily chart of TLT, the 20 year treasury bond ETF. Bond traders are selling bonds and raising interest rates because, I assume, they fear future inflation. Higher long term rates will increase the cost to the US government to borrow money and service the debt. My setups are failing. Time for me to be on the sidelines.