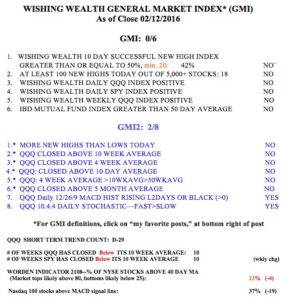

The futures are indicating a large bounce in the market on Tuesday, at least at the open. With the GMI at 0 (of 6) it is way too early to determine if this bear has died or is just hibernating for a brief time. We will go over things at my AAII workshop in Virginia next Saturday. You can register here.

I thought I should show you that the GMMA charts I use to monitor the market indexes and individual stocks can also be used to time entry and exit from mutual funds. Below are the charts for the highly acclaimed mutual finds: Fidelity Contrafund (FCNTX) and Bill Miller’s Legg Mason Opportunity Trust (LGOAX, Class A). Note the strong RWB up-trends in 2014 and early 2105. It should be clear that one could have exited these funds when their RWB up-trends dissipated. While I exit my university pension mutual funds during down-trends, I always continue new contributions as they decline. Unlike individual stocks, large mutual funds are likely to rebound when the market turns.