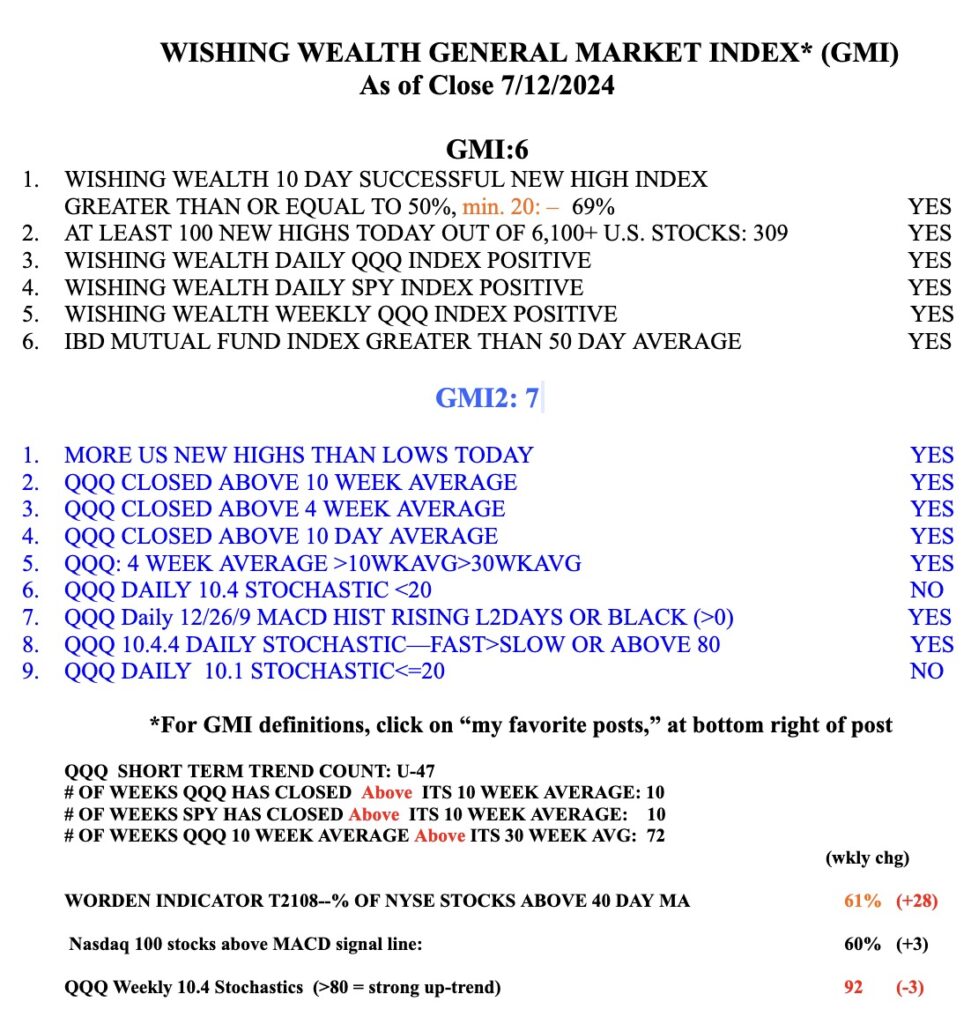

Blog Post: Day 47 of $QQQ short term up-trend; 309 US new highs and 2 lows! But tech is lagging. T2108 spikes to 61%

I am waiting to see if QQQ and tech stocks can make up for the high volume distribution day last Thursday, designated by arrows. QQQ looks extended to me on a weekly chart. But the GMI remains Green and strong. I may buy TQQQ in my trading account on a good bounce up off of support. I still am holding mutual funds in my retirement accounts.

Screenshot