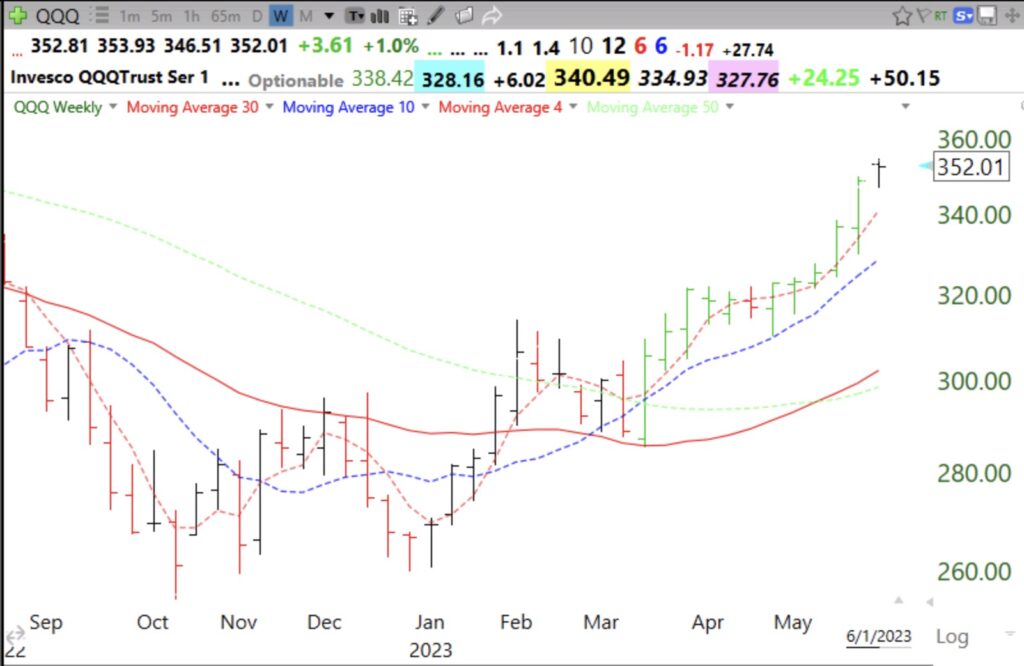

I have been transferring retirement funds from money market funds back into mutual funds. QQQ is now in a strong yellow band up-trend. See this weekly chart. QQQ is above its rising 30 week average (red line) and its 10 week average (blue dotted) is rising above the 30 week average. Note the clear space (no price bars) between the 10 and 30 week averages–my yellow band pattern. I used to fill this open space with a yellow highlighter=yellow band. A yellow band pattern is the sign of a strong up-trend. However, the current week’s bar is floating above its 4 week average (pink dotted). This suggests QQQ is extended and may fall back in line with its 4 wk average. See my 2021 Trader Lion presentation for an explanation of these chart patterns. The link is at the blog tab, Webinars.

Blog Post: Day 21 of $QQQ short term up-trend; $NVDA has GLB last week, see monthly and daily charts

This monthly chart shows that NVDA had a green line break-out (GLB) to an ATH last week. This is one fallen angel that made it back.

Here is its daily chart. Note the huge volume on the day of the break-out after earnings were released. To avoid being a failed GLB, NVDA should not close back below its green line, at 346.47.

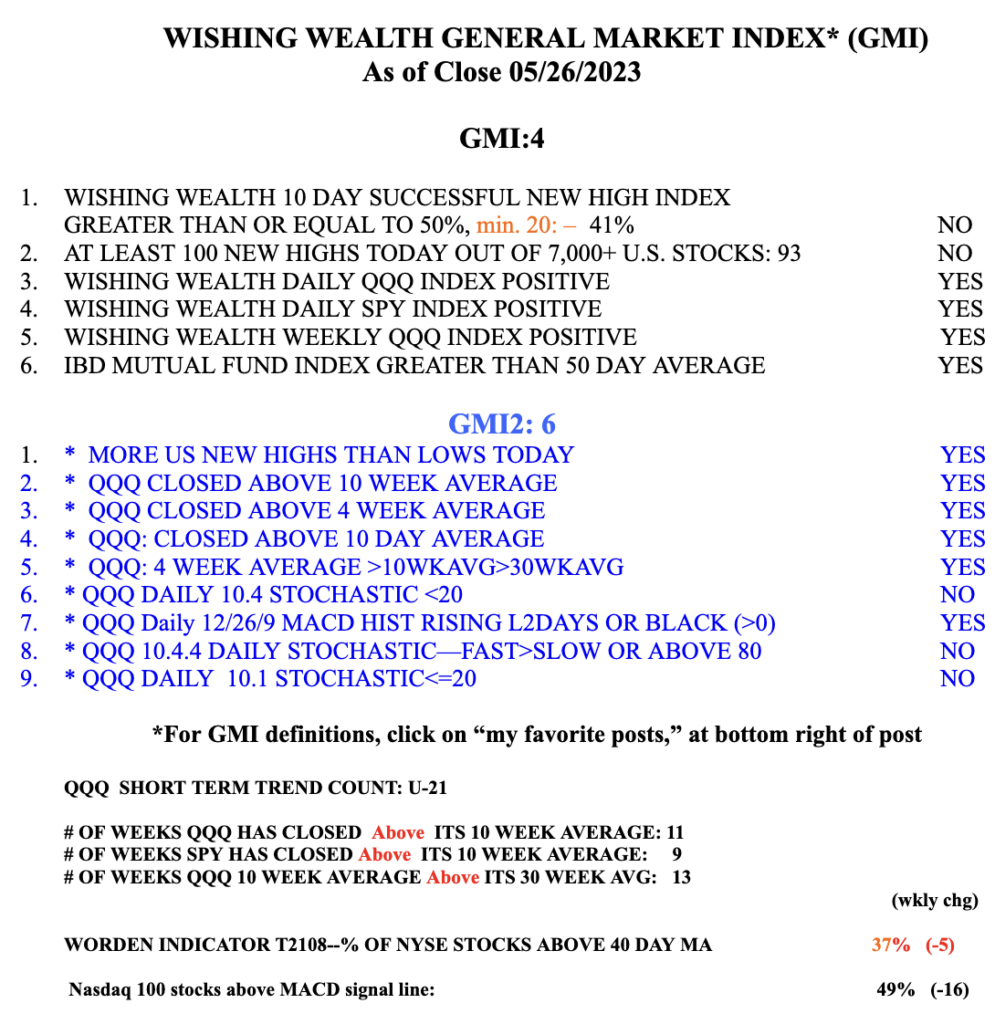

The GMI remains Green, at 4 (of 6).