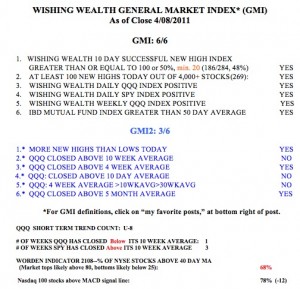

All of my GMI indicators remain positive. This week, first quarter earnings announcements begin and on Friday we have option expiration. I am still concerned about the weakness in AAPL and the QQQ. Note that the QQQ closed back below its 10 week average. Nevertheless, I must ride the up-trend for now. Click on table to enlarge.

7th day of new QQQ short term up-trend; Sell in May and go away?

While almost all of my indicators are positive, I am keeping an eye on AAPL, which is still weak. The popular explanation for AAPL’s weakness is that its weighting in the Nasdaq 100 index will be reduced on May 2. ETF’s that mimic this index will have to reduce their holdings in AAPL. I am not so sure that is the only reason behind AAPL’s weakness. This leading stock may just have been pushed to the limit for this market cycle? As we get closer to May, I always remember the analyses that show that one should “Sell in May and go away.” With the percentage of bearish advisers taking a sudden dip to 15.7%, this party may be getting late. If the percentage of bullish advisers should climb above 60% (it is now 57.3%) I will become very concerned. Sentiment is a contrary indicator, most people are bullish near market tops.

6th day of QQQ short term up-trend

The markets remain in short and longer term up-trends.