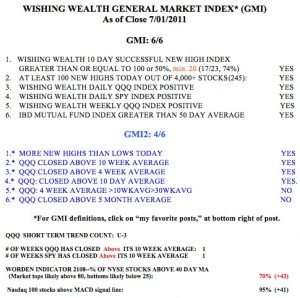

The GMI remains at 6. Usually the trend continues for a while after it reaches the 5th day. I am looking for stocks to buy.

4th day of QQQ short term up-trend

GMI is at 6 and this rally may have staying power.

Amazing snap-back, but will it hold?

IBD has today labeled the market in a resumed up-trend, even though there was never a classic follow-through day. See today’s IBD for their rationale (or rationalization). And my indicators are now positive, maybe too positive. The GMI is now 6. In just a few days, the T2108 indicator has risen to 70%, near where markets top.  And the daily stochastic that I follow for the QQQ is now near 100% and as high as it got on recent up-moves. Friday was only the 3rd day (U-3) of the new QQQ short term up-trend. This was an amazing reversal in just one week. The key to this market is whether this rise will extend to a new recovery high or peter out before. If the market cannot close at a new high (QQQ above 59.34), the ensuing decline could be violent. It is not a good idea to fight the trend of the market, however—and the trend is up, for now. I would like to see this new up-trend get to at least 5 days before I start to slowly wade back into this market.

And the daily stochastic that I follow for the QQQ is now near 100% and as high as it got on recent up-moves. Friday was only the 3rd day (U-3) of the new QQQ short term up-trend. This was an amazing reversal in just one week. The key to this market is whether this rise will extend to a new recovery high or peter out before. If the market cannot close at a new high (QQQ above 59.34), the ensuing decline could be violent. It is not a good idea to fight the trend of the market, however—and the trend is up, for now. I would like to see this new up-trend get to at least 5 days before I start to slowly wade back into this market.