With the Worden T2108 at 83% and 95% of the Nasdaq 100 stocks closing above their 30 day averages, I am reluctant to take on more long positions now. I am selling calls on long positions and waiting for a drop to support to increase my long positions. Longer term up-trend is up but I suspect we are in for the usual post-earnings release lull.

15th day of QQQ short term up-trend;CLR rocket stock

Stocks are breaking out and showing a lot of strength. Only cloud on the horizon is the T2108, now at 83%, an overbought level where tops tend to occur. Fifteen stocks showed up on my Darvas scan:

VHI,EXXI,AREX,CLR,FICO,AE,TNH,ZOLL,JAZZ,FARO,DXPE,ALXN,URI,WCG,RGR

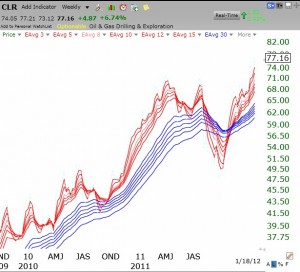

All but WCG are near all-time highs. They have great technical strength and recent earnings and are up at least 80% from their 52 week lows. This weekly GMMA chart of CLR shows it is breaking from a base to new highs and is an RWB rocket stock. Click on chart to enlarge.

14th day of QQQ short term up-trend

Short and longer term up-trends are in place. Note, however, that the T2108 is pushing 80%.