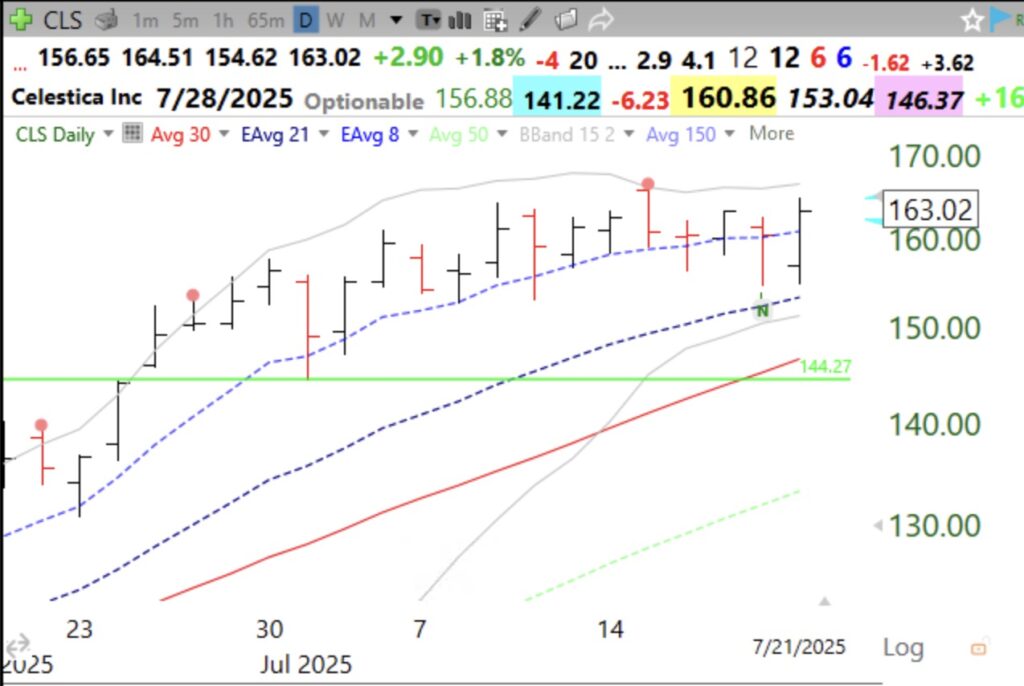

CLS had a recent GLB to an ATH, has not closed below its daily 8 EMA since then and bounced up off of that average on Monday. Let’s see if the bounce holds. Also note its weekly chart with CLS trending with the 4 wk average, a confirming sign of strength. I will describe how I trade this setup at the TraderLion conference this weekend.