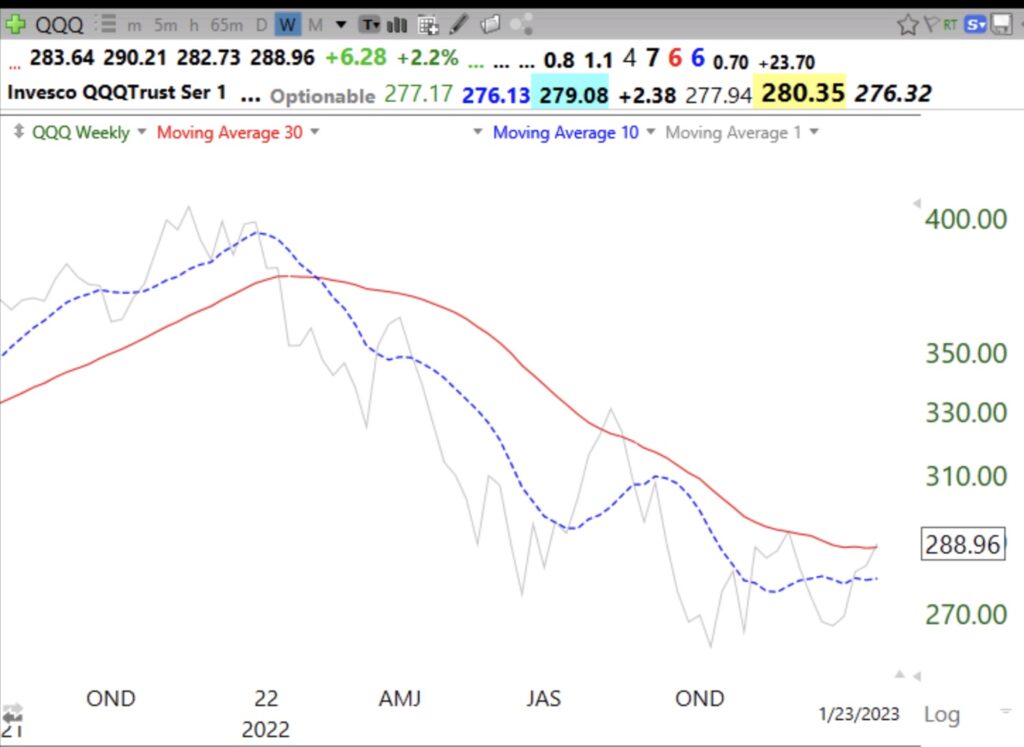

Both had a recent GLB after which they consolidated for several weeks and then broke out again. All had 4wk>10wk>30wk averages, my prime pattern for advancing stocks. They also had a weekly green bar, indicating a bounce up off of the 4 week average. Stocks at new ATHs after a market decline are often the new leaders.