$LLY may soon receive approval for their obesity drug, which may prove to be a blockbuster drug. It appears that the stock is rising in anticipation of results from a second Phase 3 trial, expected this month. This could be big if LLY can break above its green line ATH peak at $375.25. I have a very small position and will add to it if we get a GLB (green line break-out). Thanks to my stock buddy, Judy, for telling me about LLY many months ago.

All Posts

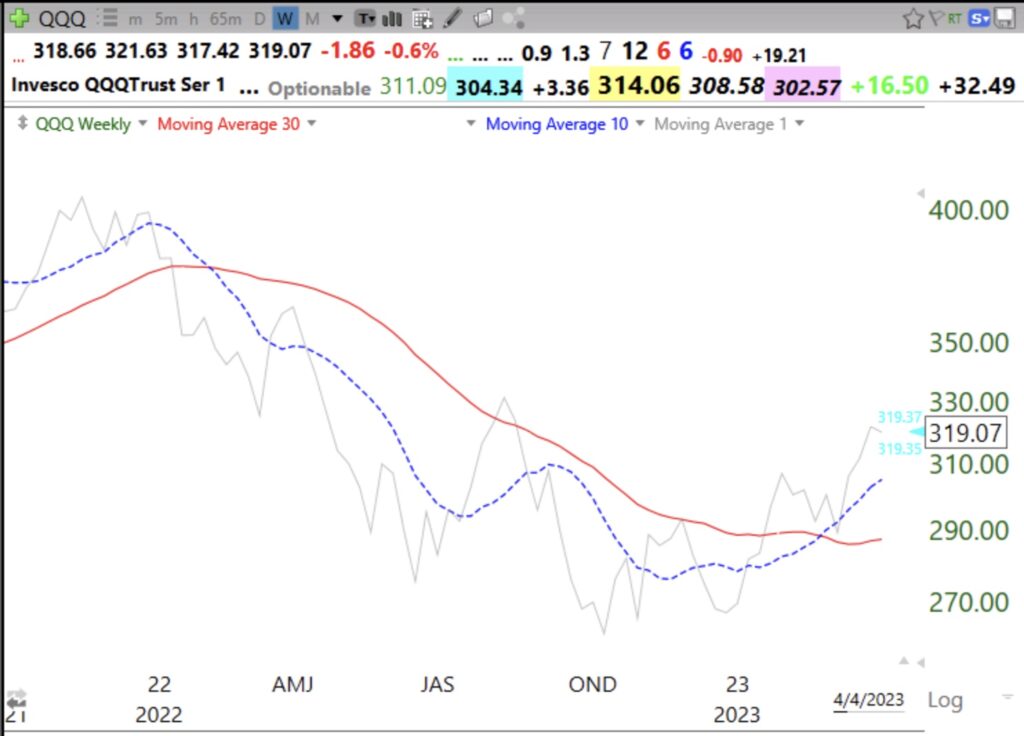

Blog Post: Day 13 of $QQQ short term up-trend; 85 US new highs and 227 new lows; $QQQ 10:30 weekly chart is strong, see how I read it

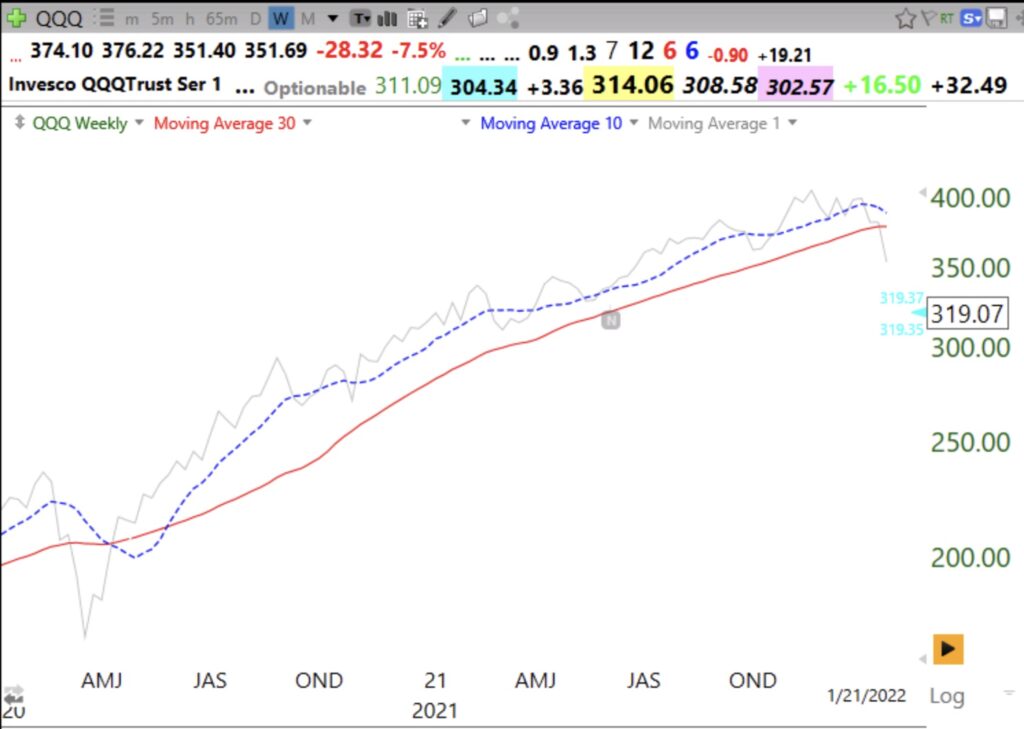

This weekly chart usually alerts me to market turns. QQQ is closing (gray line) above the 10 week average (dotted line) which is above the 30 week average (solid line). And the 30 week average is beginning to turn up. This would also be considered a beginning Weinstein Stage II up-trend. All recent market bottoms have this pattern. As long as the 10 week is rising above the 30 week average the up-trend is intact. Note the 2021 top. The first sing of weakness is a weekly close below the 30 week average.

Note the beautiful 2020-2021 bull market.