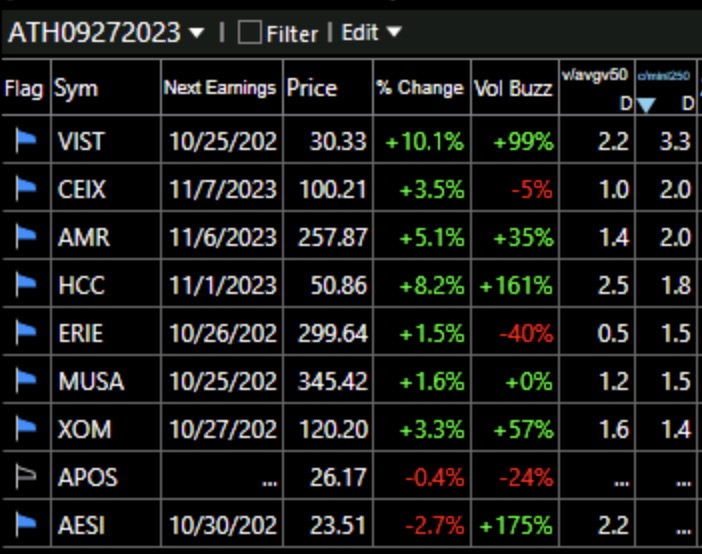

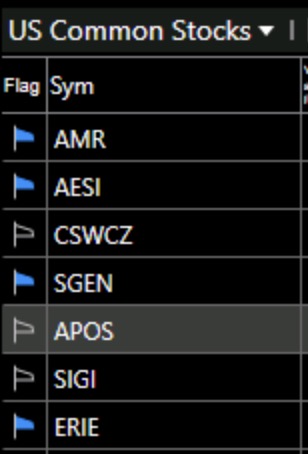

It is pretty persuasive when many of the stocks doing well come from the same industry. Here is the list of 9, sorted by Wednesday’s close/lowest price the past year. Two of them ( APOS and AESI) are IPOs within the past year and have a “…” result. Coal is hot! Even XOM made the list!