The GMI and GMI-R remain at one, reflecting the weakness in the short and longer term averages for the major market indexes. But there were 150 new highs and 25 new lows in my universe of 4,000 stocks on Tuesday. The SPY, QQQQ and DIA are still short term oversold, indicating that this rally may have further to go. The most positive sign I see is that the 30 day averages for all of these indexes have curved up (see daily QQQQ chart below). The longer term averages remain flat and could go either way.

All Posts

GMI and GMI-R still at 1; Indexes still oversold; DXCM

I am on vacation this week and cannot do all of my customary analysis. Markets still look like they could bounce this week, but they remain in a down-trend. One of Judy’s picks hit a new high on Monday, DXCM. Be careful.

Raising cash; some submarine stocks; Indexes’ daily stochastics oversold

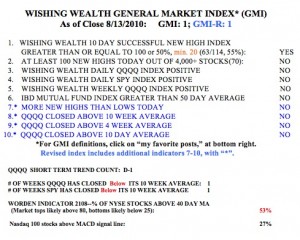

With the GMI and GMI-R now at one, the technical signs are just too weak to own stocks. The QQQQ has just started a new short term down-trend (D-1) by my criteria. The 30 week average of the QQQQ is flat, which leads to many whipsaws of the indexes above and below the shorter term moving averages.  For example, the last short term down-trend lasted just 4 days, then we had a brief 15 day up-trend, which just ended. The SPY and QQQQ are now below their 10 week averages. My long trades are most likely to be profitable when these indexes remain above their 10 week averages. Only 27% of the Nasdaq 100 stocks now have their MACD above its signal line, a sign of short term weakness. Finally, the Worden T2108 indicator is at 53%, in neutral territory. So, we are in a declining market, but not yet in an oversold state. Most market declines end with the T2108 below 20%. And soon we enter the typically weakest month of the year for the market–September.

For example, the last short term down-trend lasted just 4 days, then we had a brief 15 day up-trend, which just ended. The SPY and QQQQ are now below their 10 week averages. My long trades are most likely to be profitable when these indexes remain above their 10 week averages. Only 27% of the Nasdaq 100 stocks now have their MACD above its signal line, a sign of short term weakness. Finally, the Worden T2108 indicator is at 53%, in neutral territory. So, we are in a declining market, but not yet in an oversold state. Most market declines end with the T2108 below 20%. And soon we enter the typically weakest month of the year for the market–September.

In a market like this there are many submarines–stock in likely longer term down-trends. Some of them picked up by my submarine scan are: BBBB, SNX, RTN, WDC, JCG, MR, VPRT, MD, TEVA, ASIS, LIFE, MHS, SLAB, ATHR. During market down-trends, I sometimes buy deep in the money puts on submarine stocks in my IRA. There is one caveat keeping me from entering new short positions right now. The daily stochastics for the DIA, SPY and QQQQ are in oversold territory–we may get a bounce during the coming week of options expiration.