I am inviting all of you to attend my second Worden webinar with the talented Julia Ormond Tuesday evening. To register for the free webinar, go to www.worden.com. If you miss it or missed my first webinar, the Worden staff archive them on their site for later viewing. I will talk about the current market trend and the Submarine Scan I use to identify potential shorts.

This market has continued to frustrate me.  The longer term averages remain flat and the short term averages remain in a down-trend. Since May 6, the day of the flash crash, the range of the market has been cycling between that day’s high and low (41.55 to 48.32). The only exceptions were three days that occurred the week after the flash crash when the QQQQ traded slightly above this range. So, we have been in a roller coaster market as this daily chart of the QQQQ shows (click on to enlarge). My suspicion is that a new trend may assert itself when the QQQQ breaks out of this range. Until then, the odds of making money are probably low for me, as a swing trader. This type of volatility is probably more easily traded by day traders.

The longer term averages remain flat and the short term averages remain in a down-trend. Since May 6, the day of the flash crash, the range of the market has been cycling between that day’s high and low (41.55 to 48.32). The only exceptions were three days that occurred the week after the flash crash when the QQQQ traded slightly above this range. So, we have been in a roller coaster market as this daily chart of the QQQQ shows (click on to enlarge). My suspicion is that a new trend may assert itself when the QQQQ breaks out of this range. Until then, the odds of making money are probably low for me, as a swing trader. This type of volatility is probably more easily traded by day traders.

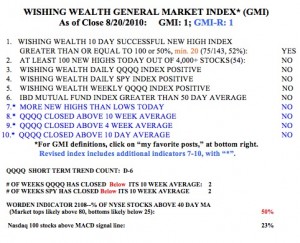

So, with the GMI and GMI-R both registering one, I must remain mainly in cash. One of the most difficult lessons to learn is to stay out of the market when the conditions are not optimal.  When the GMI is 4 or above and the QQQQ is above its rising 10 week average, my methods tend to give me a good chance of trading profitably. But the QQQQ, SPY and DIA have now closed below their 10 week averages for the past two weeks. The Worden T2108 indicator is at 50%, in neutral territory. Only 23% of the NASDAQ 100 stocks closed with their MACD above its signal line, a sign of short term weakness. When only 54 stocks out of more than 4,000 in my stock universe can hit a new high ( on Friday) then my strategy of buying stocks at all-time highs is a low probability bet. The QQQQ has now completed the 6th day of its current short term down-trend (D-6). The last up-trend lasted 15 days, the preceding down-trend lasted 4 days, and the preceding up-trend lasted just 3 days. I can’t ride a stock for long in a market with such short swings. I can trade profitably during the more typical 30-80 day trends. So, I remain mostly in cash with a few put options on stocks that came up in my Submarine Scan, and a small position in the 3X tech bearish ETF, TYP. I am prone to betting on market weakness during the September/October period, as long as my indicators remain bearish.

When the GMI is 4 or above and the QQQQ is above its rising 10 week average, my methods tend to give me a good chance of trading profitably. But the QQQQ, SPY and DIA have now closed below their 10 week averages for the past two weeks. The Worden T2108 indicator is at 50%, in neutral territory. Only 23% of the NASDAQ 100 stocks closed with their MACD above its signal line, a sign of short term weakness. When only 54 stocks out of more than 4,000 in my stock universe can hit a new high ( on Friday) then my strategy of buying stocks at all-time highs is a low probability bet. The QQQQ has now completed the 6th day of its current short term down-trend (D-6). The last up-trend lasted 15 days, the preceding down-trend lasted 4 days, and the preceding up-trend lasted just 3 days. I can’t ride a stock for long in a market with such short swings. I can trade profitably during the more typical 30-80 day trends. So, I remain mostly in cash with a few put options on stocks that came up in my Submarine Scan, and a small position in the 3X tech bearish ETF, TYP. I am prone to betting on market weakness during the September/October period, as long as my indicators remain bearish.