I identified the beginning of the new QQQQ short term up-trend on September 7th. The GMI on that day registered 5 (of 6). One of the lessons I learned from the great Nicolas Darvas is to use one’s own judgment and to insulate oneself from the news, media pundits and other traders. He learned this lesson when he returned to NYC after making a lot of money trading while he danced around the world, only to find that he lost his objectivity and his ability to trade profitably when he was in NYC around other traders. By definition, when a new up-trend is beginning, most people will be expecting a continuation of the current down-trend or flat pattern. In early September, when the GMI was flashing a buy signal, most people were talking about a double dip or head and shoulders top. The key to being on the right side of the market is to observe closely what the market is doing. I therefore fly on instrument and tune out everything else. Remember, Darvas used to get Barron’s in the mail and proceed to rip out all of the pages except the stock quotations.

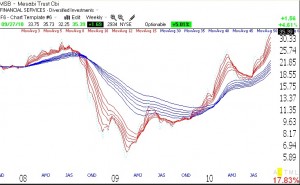

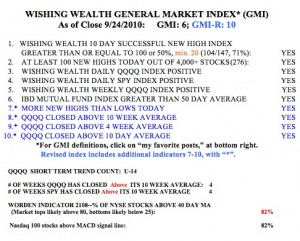

And so the GMI remains at 6 (of 6) and the GMI-R at 10 (of 10).  The SPY and QQQQ have closed above their critical 10 week averages for four weeks. The QQQQ completed the 14th day of its current short term up-trend on Friday. The Worden T2108 remains over 80%, which is near overbought levels, but it reached 89% in August, 2009. A high reading of the T2108 is not as predictive as an extremely low reading, below 10%. 82% of the Nasdaq 100 stocks had their MACD above its signal line, down from 94% last Friday. This indicator bears watching, because it is very sensitive to the short term trend. Note that buying stocks at new highs has been a promising strategy lately, with 71% of the stocks in my universe that hit a new high 10 days ago, closing higher on Friday than they did 10 days earlier (see the Wishing Wealth Successful New High Index in this table). Most of the stocks listed on the lower right of my site have been powering ahead to new all-time highs. I never can understand why most people who want to own a rocket, refuse to buy stocks trading at highs. A rocket on the way to the moon has to hit many daily new highs along the way……

The SPY and QQQQ have closed above their critical 10 week averages for four weeks. The QQQQ completed the 14th day of its current short term up-trend on Friday. The Worden T2108 remains over 80%, which is near overbought levels, but it reached 89% in August, 2009. A high reading of the T2108 is not as predictive as an extremely low reading, below 10%. 82% of the Nasdaq 100 stocks had their MACD above its signal line, down from 94% last Friday. This indicator bears watching, because it is very sensitive to the short term trend. Note that buying stocks at new highs has been a promising strategy lately, with 71% of the stocks in my universe that hit a new high 10 days ago, closing higher on Friday than they did 10 days earlier (see the Wishing Wealth Successful New High Index in this table). Most of the stocks listed on the lower right of my site have been powering ahead to new all-time highs. I never can understand why most people who want to own a rocket, refuse to buy stocks trading at highs. A rocket on the way to the moon has to hit many daily new highs along the way……

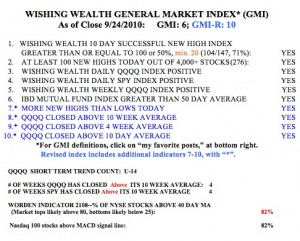

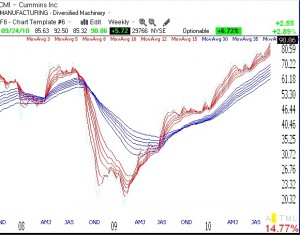

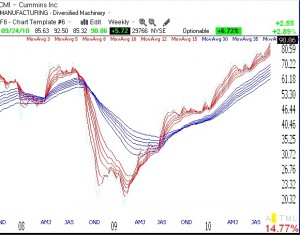

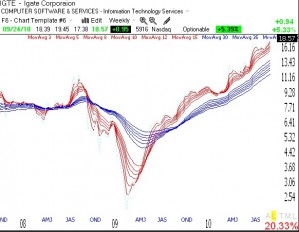

Speaking of rockets, I have coined the term Red White and Blue as a simple way of characterizing the weekly chart pattern of promising rocket stocks. I derived this term from one of my students from last year (Marcus) who labeled three moving averages with these colors and wanted the red average to be above the white average, followed by the blue average. I am applying these colors to weekly GMMA charts a little differently, where the red lines are the shorter term averages and the blue lines are the longer term averages. The key to a rocket stock is the presence of a white space between the rising short and long term averages. It is this white space that shows me that the stock is likely to be a rocket. This pattern is universally applicable to rocket stocks. Below are two examples. (Click on charts to enlarge.) In the future I will be discussing Red White and Blue (RWB) stocks. Note that a submarine stock is the opposite (BWR), with the shorter term averages below the longer term averages. In fact, CMI is a great example of a submarine stock that has transformed itself into a rocket.

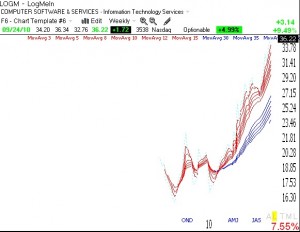

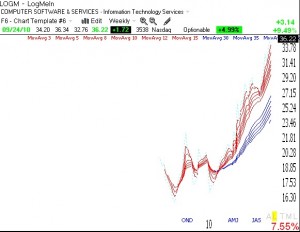

Another RWB stock that came up in my Darvas scan is LOGM, which has been on fire since March. While I never know how long a trend will last and must always manage the risk of a change in trend, if I am going to own a stock, I want it to be RWB on a weekly chart.

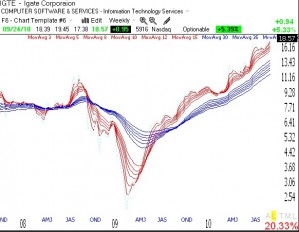

Finally, IGTE shows that a stock can remain RWB for a long time. The key is to get on board and to sit tight, much as the great Jesse Livermore advised. If one has the patience to ride a RWB stock for a year, one can calmly let his/her account grow, without excessive day trading and the accompanying stress that frequent trading creates.

I urge my students to paste copies of these stocks to their computer monitors and to compare all potential purchases to them. Accept no less!