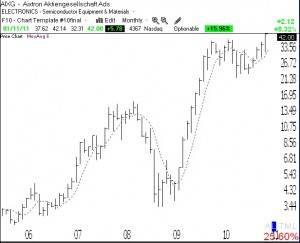

AIXG was a ten bagger in 2009. It then consolidated for a year and recently broke out from what may be a powerful flag pattern. Check out this monthly chart of AIXG. This stock, which also has triple digit earnings increases, should be watched closely for an entry.

All Posts

35th day of QQQQ short term up-trend

Short and long term trends remain up.

Rare earths stocks stall; Judy’s pick: LYSCF; New IBD 50 list

The rare earths stocks stalled on Thursday. Judy had told me that the lock-up period for MCP, when insiders from an IPO cannot sell their shares, expires this month. After the stock recovers from the anticipated selling, MCP may be a good buy again. Meanwhile, Judy told me about LYSCF, a small company developing a new mine for rare earths. I bought a few shares just to keep it in mine (pun intended)….

With the new year, IBD has apparently shrunk the IBD 100 list down to 50 stocks. The new IBD 50 list contains a more selective set of stocks to watch. I will run some performance tests in the future to see if this list does in fact perform better. Most of my buys have come from stocks on their IBD 100 and New America lists….