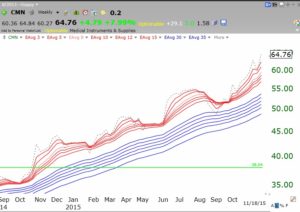

I have been watching EA ever since my stock buddy, Judy, told me about their likely benefiting from their games with a Star Wars theme. When EA bounced from support on Thursday, I purchased some. EA may be retaking its green line break-out. If it breaks below support I will quickly sell. Star Wars comes out on December 18.