Dr. Wish

Dr. Wish

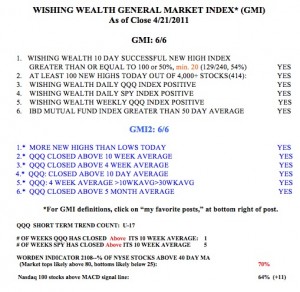

16th day of QQQ short term up-trend

Well, we all know now that the bounce off of support by AAPL earlier this week was for real. The up-trend continues….. Markets are closed Friday.

GMI back to 5; AAPL holds support

It looks like AAPL has held support into earnings release Wednesday. Strong market on tap for today’s open. With GMI back to 5, I am looking for buys.