After adjusting trading volume for the shorter trading day on Friday, IBD said Friday constituted a follow-though day of the rally and proclaimed a new up-trend. The GMI and GMI-2 are both at 3 and could easily give a buy signal this week. Two consecutive days with the GMI above 3 will produce a new buy signal. However, IBD is so good at calling the market’s trend that I will respect their opinion and exit my small short in position in SQQQ and start to slowly go long the TQQQ in stages. If this is a new up-trend there will be plenty of time to accumulate TQQQ on the way up. I am also impressed at the recent relative strength of FB, which I own.

Dr. Wish

Dr. Wish

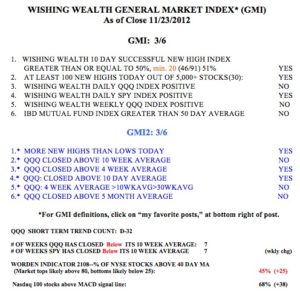

31st day of QQQ short term down-trend; correction continues; FB strong

The market is not out of the woods. IBD still calls it in a correction. And the GMI is only 1 (of 6). The market is no longer oversold. I am watching AAPL for clues of the market’s trend. A close of AAPL above 591 would suggest significant strength. But its 10 week average is about to cross below its 30 week average, a sign of weakness.

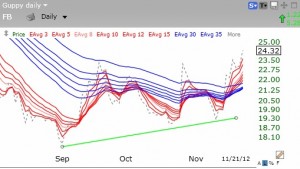

Meanwhile, FB continues to show strength, now closing at $24.32. The daily Guppy GMMA chart shows that the short term averages (red lines) are now rising above the long term averages (blue lines), a major sign of strength. I own some FB.

Bounce continues but is this a bear market rally?

IBD still sees the market in a correction. Monday’s trading volume was lower then Friday’s. Monday was the 29th day of the current QQQ short term down-trend. The T2108 indicator is at 30%, well out of oversold territory. The key to the market is how this rally performs. The market is not out of the woods because of a couple of days of advances. This could be a dead cat bounce. Only time will tell. I may not be able to post on Wednesday.