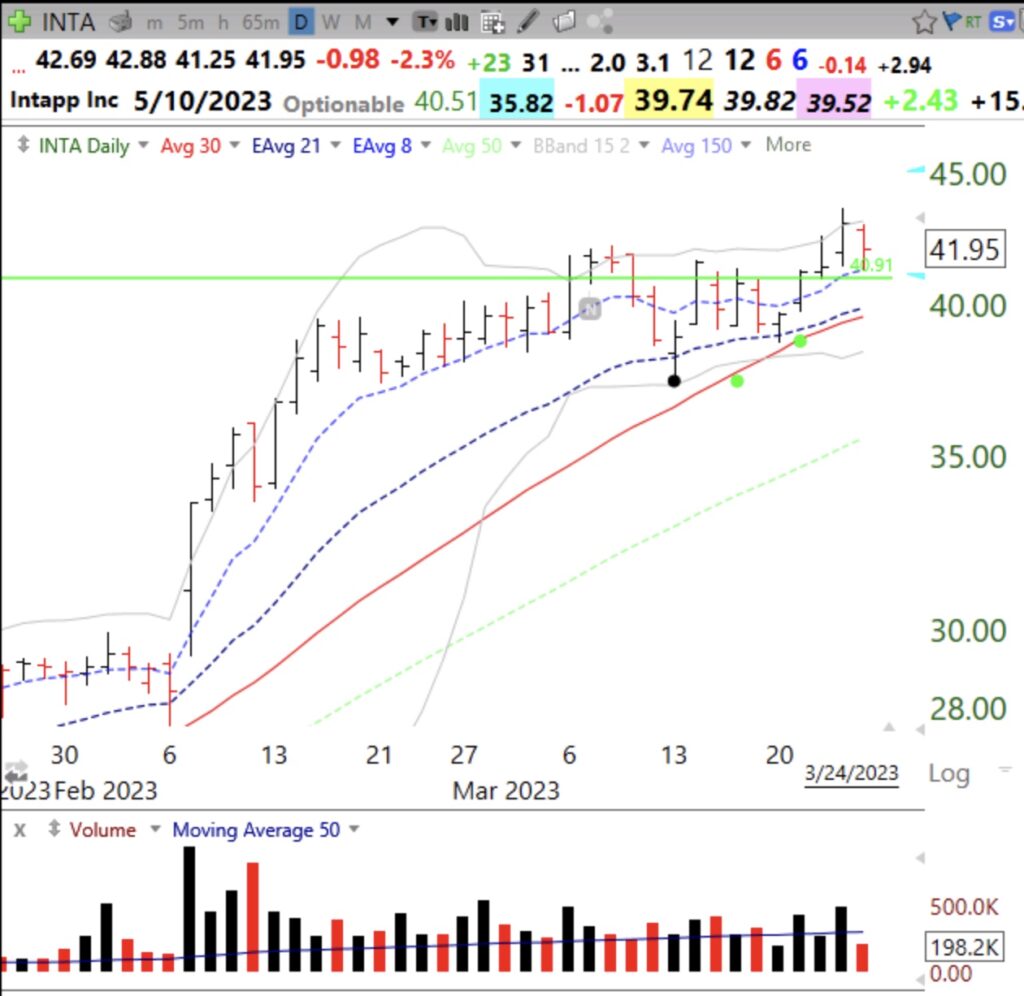

It is always nice when IBD lauds a stock that I have been following based on my indicators. I first noticed INTA when it closed above its green line on March 7 and closed at an ATH (GLB). It then closed above and below its green line several times. On Tuesday it climbed above the green line on above average volume and had a big volume day on Thursday, closing at a new ATH again. On Friday it held the green line. It will be interesting to see if IBD’s article creates buying this week. Here are the daily and monthly charts. I became even more interested in INTA when I saw it was a recent IPO and had a GLB to an ATH. This is a very bullish pattern. The fundamentals of INTA are strong and reviewed in this week’s IBD, 3/27, p. A6.

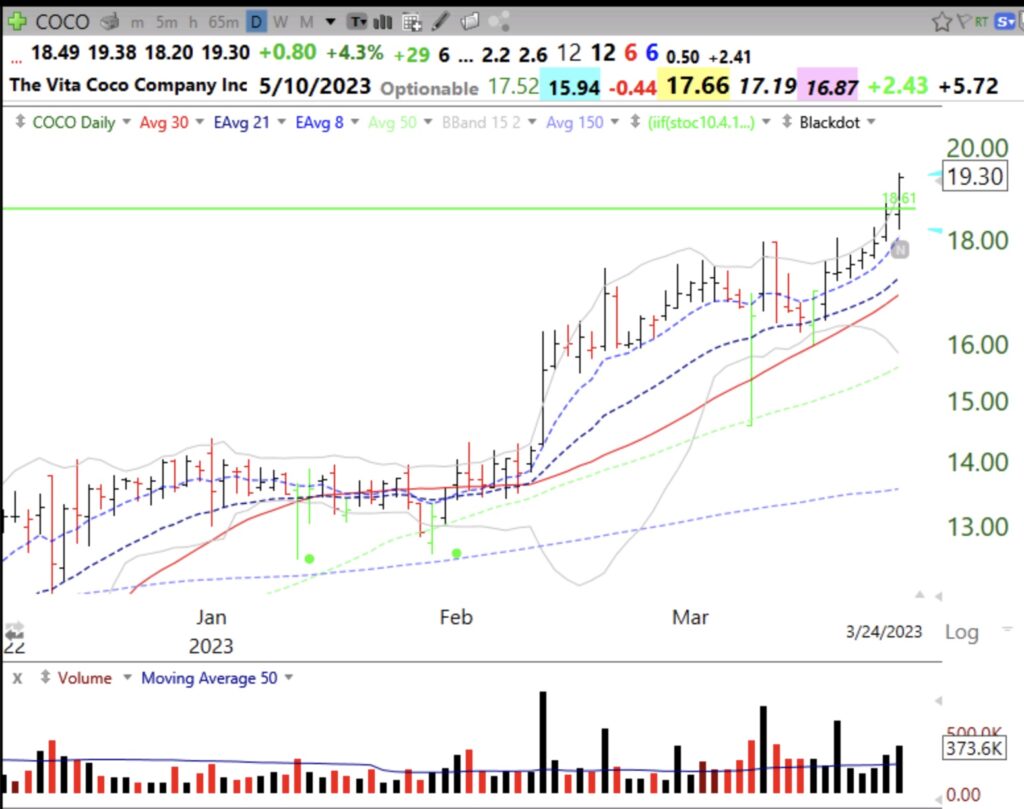

$COCO, another recent IPO, reached an ATH and GLB Friday on above average volume. I am monitoring COCO. Here are its daily and weekly charts. Note recent black volume spikes on the daily. Someone big is accumulating COCO.

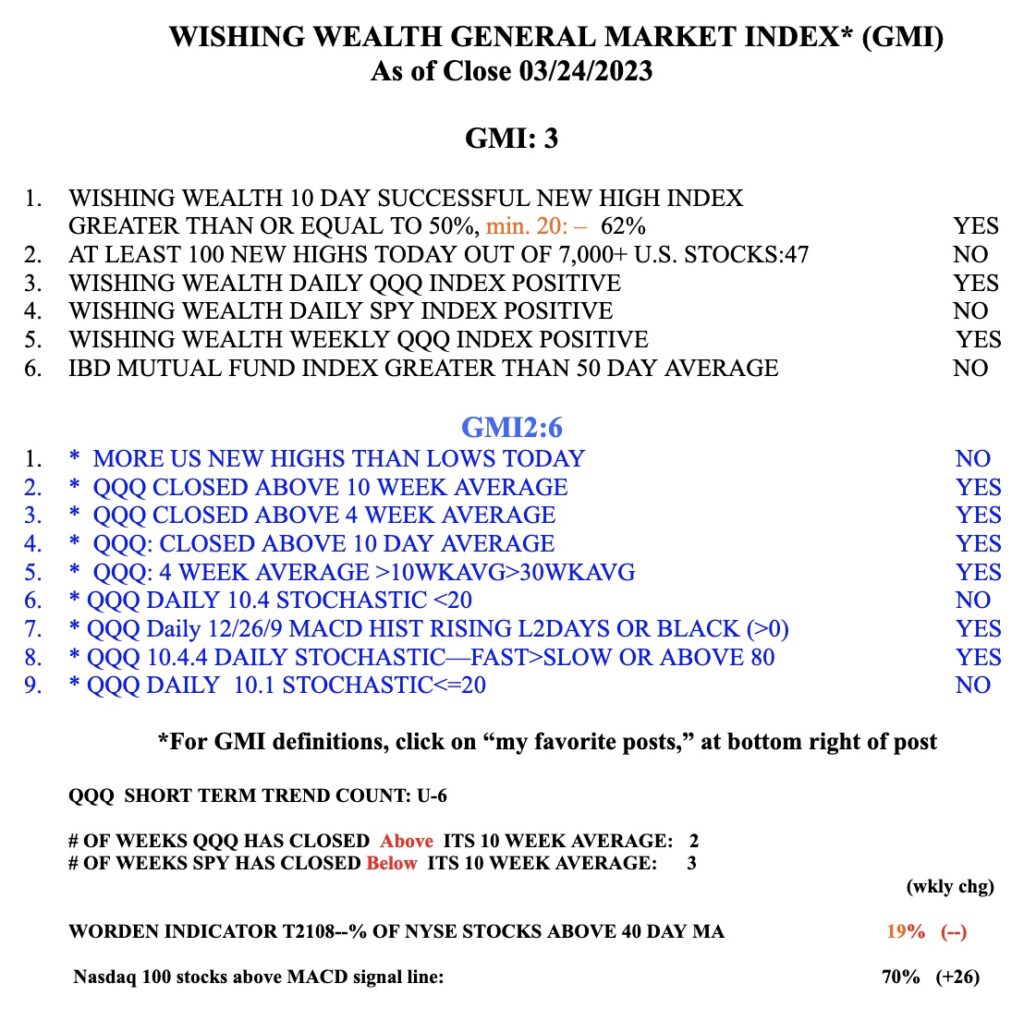

The GMI remains Red. However, tech stocks are outperforming. Remember, QQQ is composed of non financial stocks and does not contain the sinking bank stocks. With bond interest rates declining, I suspect it will eventually cause all of the people hiding safely in interest bearing treasuries to stampede back into stocks. I think the market bottom is in, especially when I hear the CNBC Fast Money pundits Friday all talking very bearishly…. And T2108 closed at only 19%, having reached 13% last week. Major index ETFs have their 10 week averages above their 30 week averages. This the time for me to look towards going back into the market slowly and accumulating only on the way up.