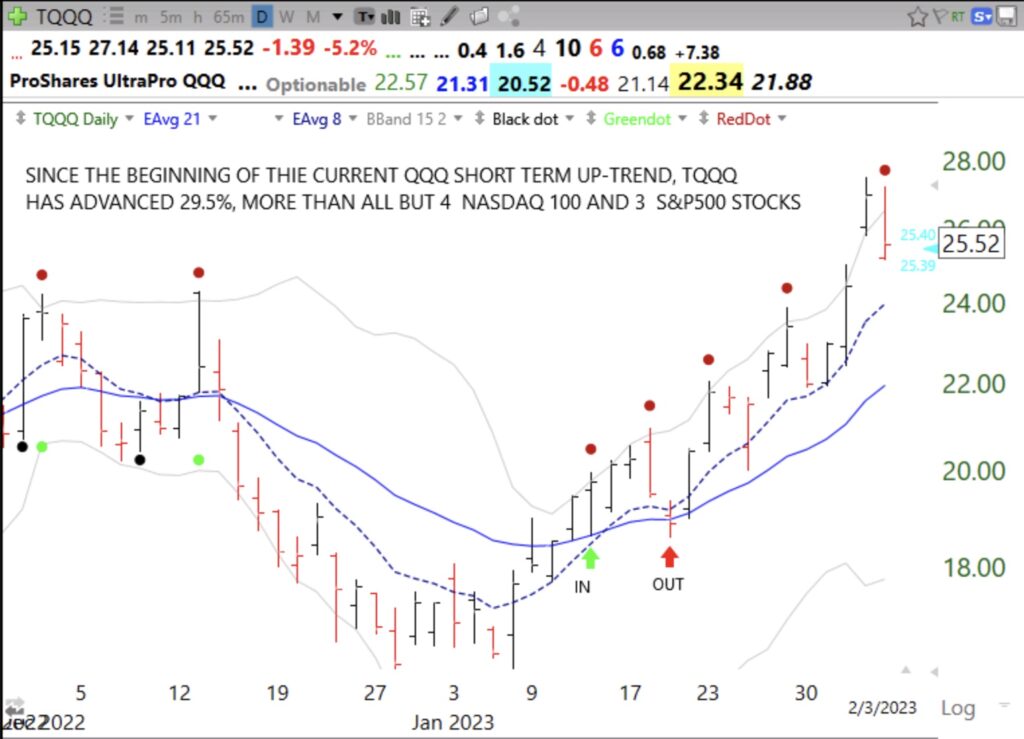

I confess I did buy some TQQQ at the beginning of the new QQQ short term up-trend (green arrow on chart) and posted about it, but allowed myself to get shaken out on 1/19 (red arrow) and did not buy back in. Not buying back in compounded my first mistake. I need to let my computer trade for me because I let myself be shaken out even though my objective rules said that the short term up-trend was still intact :-(. See the daily chart of TQQQ below.

TQQQ even beat all but 4 of the 668 stocks in my aggregate watchlist of recent IBD50 and MarketSmith Growth 250 stocks! If you search my blog on “TQQQ” you will find that I have replicated this analysis and found similar results for years. Maybe it just does not pay for me to try to find winning individual stocks when I can just buy the 3x leveraged ETF, TQQQ. By the way, I also found 16 leveraged ETFs that beat TQQQ! TSLL, CONL and KOLD were each up over 80%! Remember, however, these leveraged ETFs fall much faster than the underlying index or security when the trend reverses down, so you need a really good exit strategy, especially one better than mine!

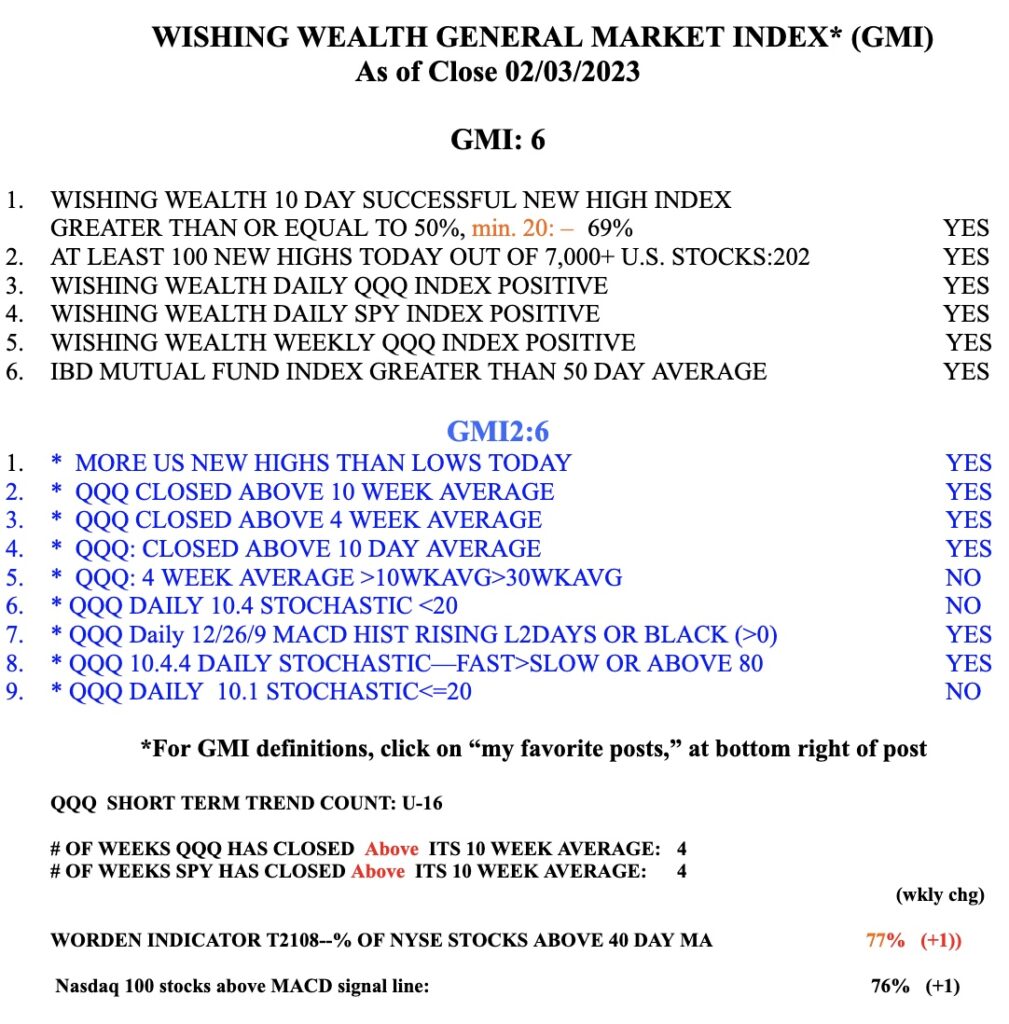

The GMI signal remains Green at 6 (of 6). It flashed Green at the close on January 13. I post my QQQ short term trend count in the table below and on each almost daily blog post.

Dear Dr. Wish, the same happened to be as I used 10ct below the day’s low when I bought. Could you give a suggesion for a better stop level? Have you done any study on what stop level would keep you in the uptrend without losing too much when the uptrend fails? (as the uptrend has failed a vouple of times before in the last year)

“Maybe it just does not pay for me to try to find winning individual stocks when I can just buy the 3x leveraged ETF, TQQQ.” Well, not if you’re going to be shaken out. If you are not shaken out of your stocks then perhaps that’s where you should be. Those leveraged ETFs are more volatile, thus more apt to shake traders out. Or you need an indicator that keeps you in.