Often times a major advance is characterized by the stock or ETF tracking its 4 week moving average. When it closes the week below that average it often means the rise is weakening or ending. The long rise from October 2019 through February 20202 lasted 21 weeks. In only one of those weeks did QQQ close the week below its 4 week average (red dotted line) although sometimes it traded intraweek below the average. When the stock’s weekly low is floating above the average, it often returns to kiss it. This is what happened last week. The QQQ returned to kiss the 4 week average. It is critical that it close above it next Friday. The QQQ has closed above its 4 week average the past 4 weeks. However, a strong up-trend has the 4wk>10wk>30Wk, as was the case during the prior 21 week advance.

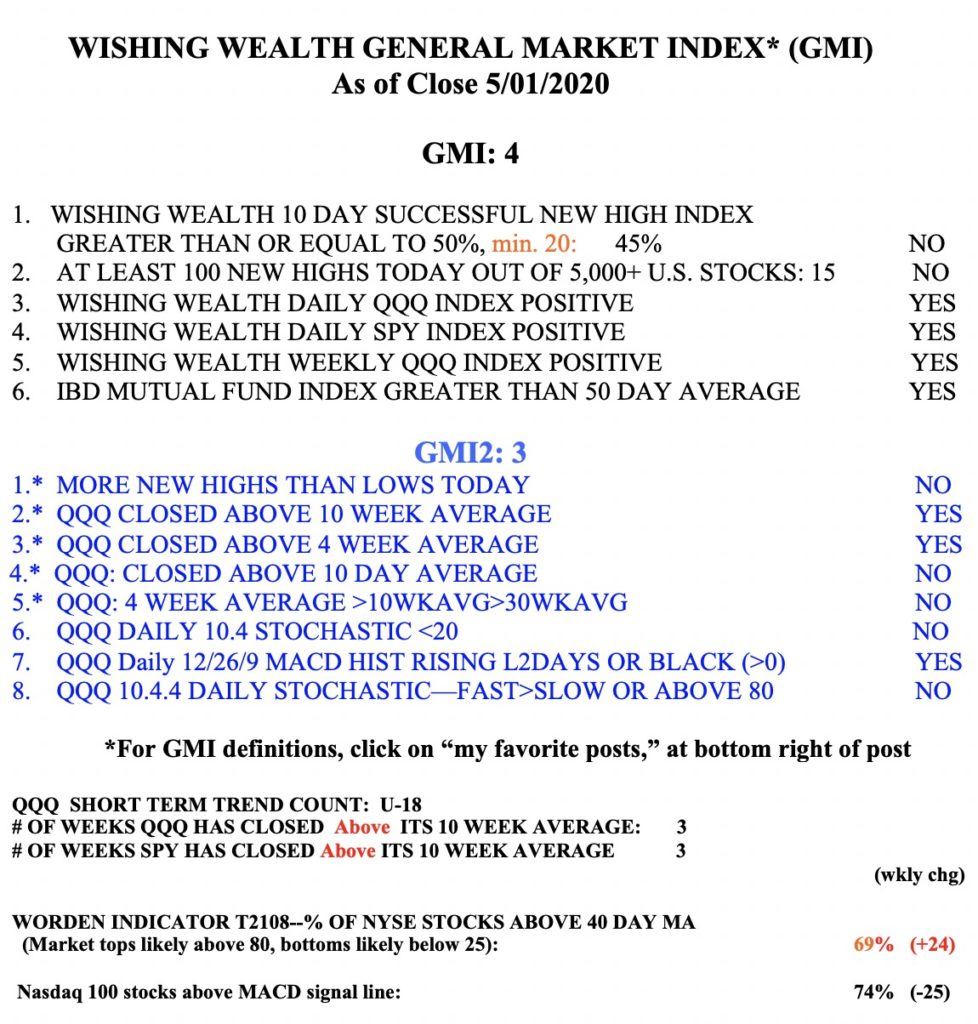

The GMI remains Green at 4 (of 6) but the shorter term GMI-2 has weakened to only 3 positive elements (of 8). New highs are still rare these days.