I have repeatedly shown that the way to beat most stocks during an up-trend is to simply buy the triple leveraged bullish QQQ ETF, TQQQ. As long as the QQQ is in an up-trend, TQQQ rises more than almost all individual stocks. Since my QQQ short term trend indicator turned up on April 7, TQQQ has advanced 33%. Of all stocks in the major indexes (DIA, QQQ, SPY) only TSLA advanced more (+38%). In my big watchlist of IBD and MarketSmith type growth stocks, only 2% (18/809) beat TQQQ. For my time and money, I would rather buy TQQQ in an up-trend than try to identify in advance the rare needle in the haystack stocks that will beat it. My strategy is to take a small position in TQQQ as soon as there is a new QQQ short term up-trend. If the up-trend continues, I add more at higher prices over time. However, because TQQQ also falls 3x faster than the underlying index, I must have a strategy to protect gains.

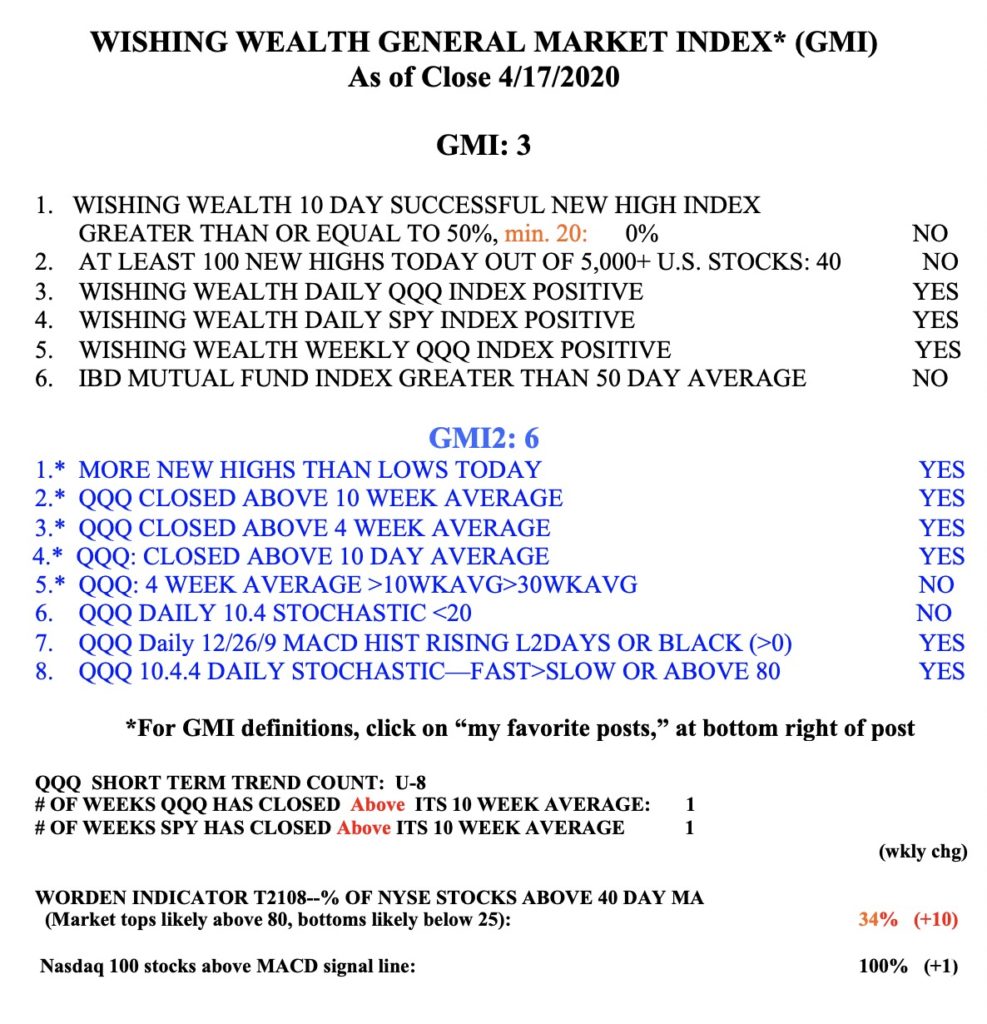

The GMI remains RED and at 3 (of 6). It could turn GREEN this week. The SPY and QQQ have now closed back above their 10 week averages.

Dr Wish, What exit strategy are you thinking for TQQQ? I am considering getting long TQQQ. For exit, ATR trailing stop or close below 30D EMA looks reasonable to me.