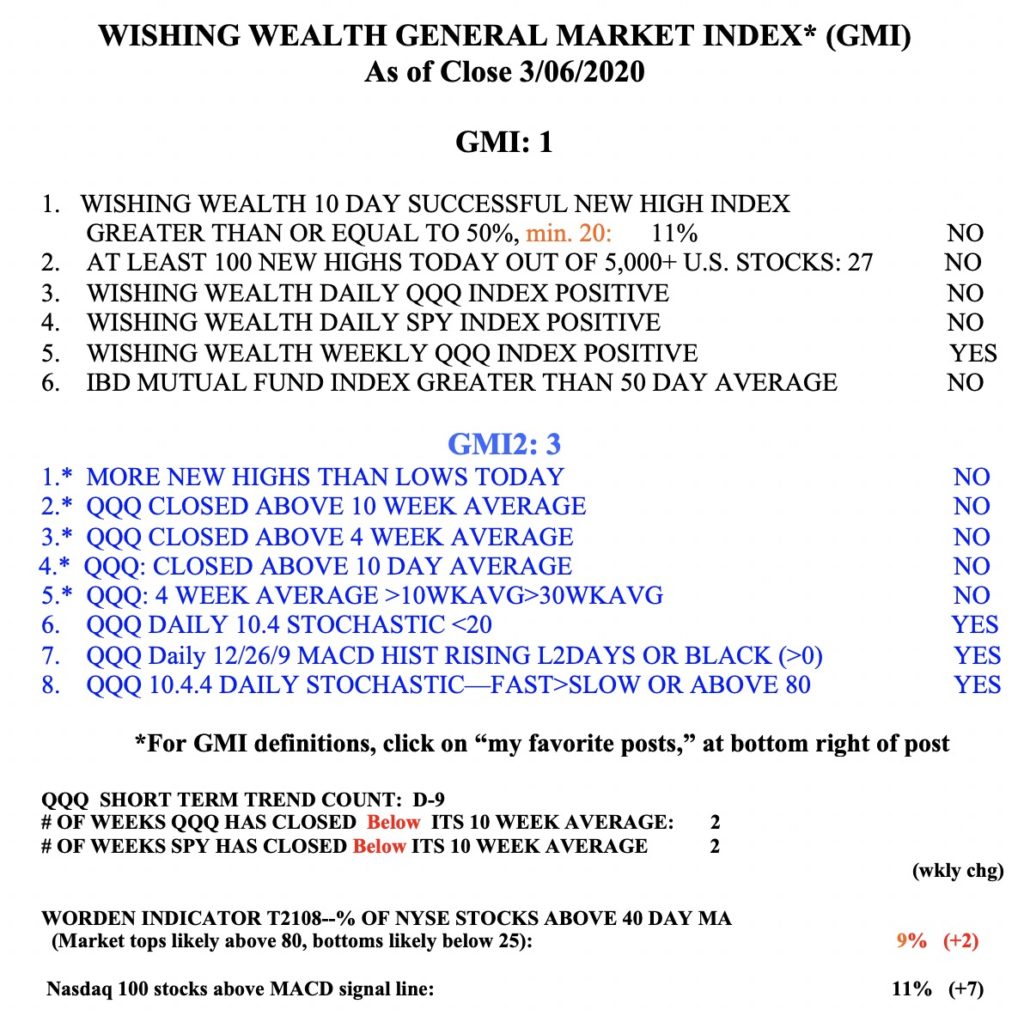

I remain largely in cash and holding a little SQQQ in my trading IRA. My university pensions are in money market funds. As a trend follower, I know I will go long again only after it looks like a bottom is in. The decline thus far has been small and in 2000 and 2008 the market rallied after I got out, I then believed I had misjudged the market, and then the bottom dropped out. So I do not know if we will enter a bear market with declines of 20% or more. We all know that business is being hurt in the short term but the market will look past the near term weakness to the recovery. For now, I remain comfortably on the sidelines and watching the daily GMMA chart of the major indexes. SPY is now in a daily BWR down-trend (see chart below) but the put/call ratio (1.22) and T2108 (9%) are flashing the type of extreme weakness that often precedes a rally. When a new RWB up-trend pattern emerges like the one that began last October, I will start tiptoeing back into this market. Friday was the 9th day of the new $QQQ short term down-trend. Stay tuned….