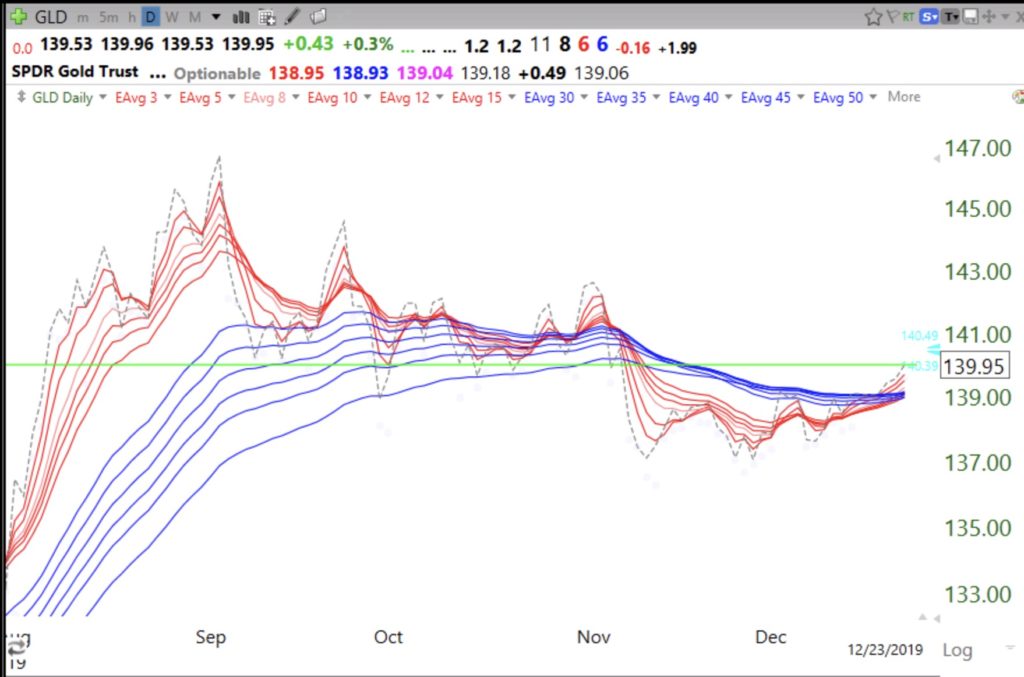

I bought some March call options on GLD yesterday after I noticed that GLD was above all 12 moving averages in the daily RWB chart. It is a low risk play because the options were cheap and if GLD fails and closes back below all of the averages I can exit with a small loss. GLD could be coming out of a daily BWR down-trend and beginning a new daily RWB up-trend?

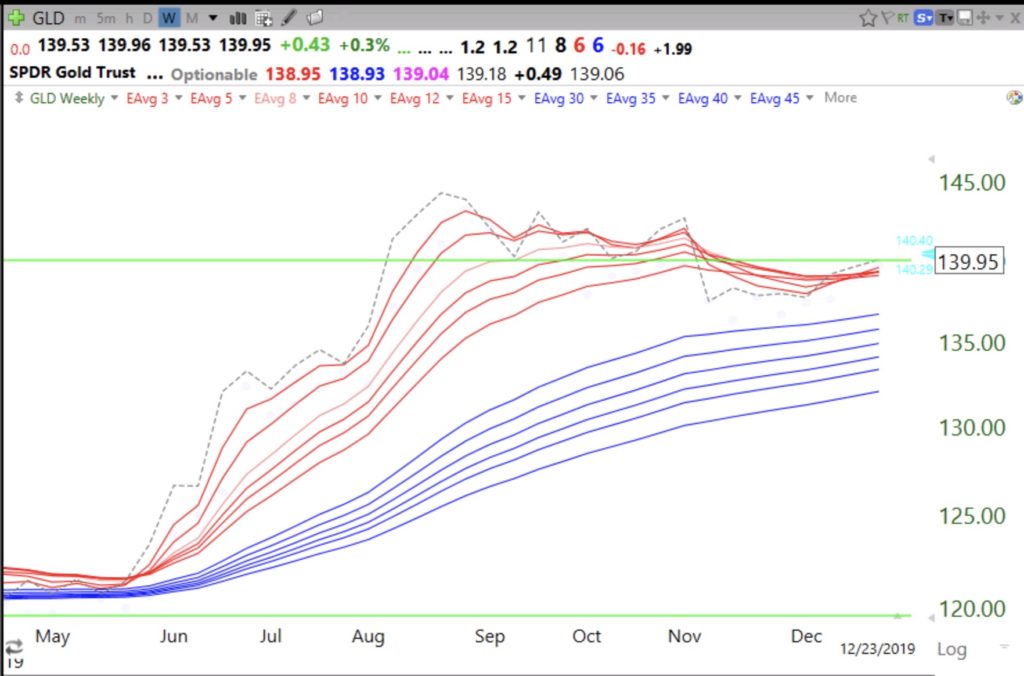

GLD remains in a weekly RWB up-trend, so the short term trend could be turning up within a longer term up-trend. I will leave it to economists to explain what a rise in gold may portend.