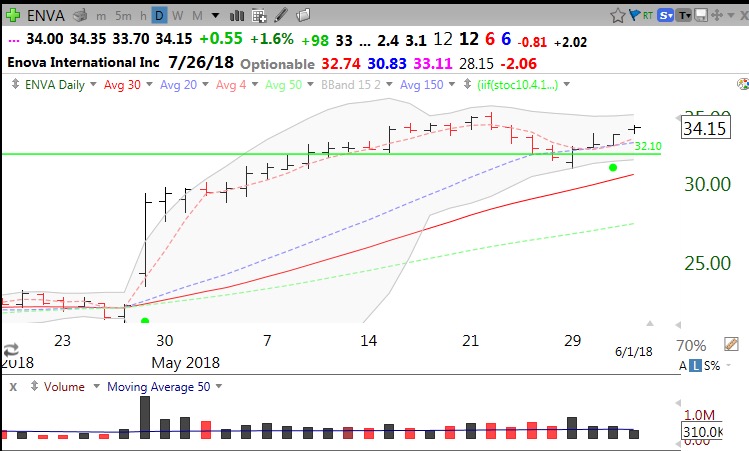

As my readers know, I like to buy stocks that have broken out to an all-time high, after they have rested for at least 3 months. I draw a green line at the peak price not surpassed for at least 3 months and wait for a close above the green line, the green line break-out (GLB). Below are three recent GLB stocks that have re-tested their green line and appear to be holding up. All three have doubled over the past year, another important sign I look for. Stocks that have doubled often go on to double again. I also look for above average volume on the day of the break-out. I like to buy such stocks on the day of the break-out or afterwards when they consolidate or bounce off of support or give a green dot signal. I never hold a GLB stock that closes back below the green line but will buy it back if it retakes it. Some of my best gains have come from stocks that have shaken me out for a small loss and then produced another buy signal. The table to the right of this post provides a list of some recent GLB stocks. Below are 3 recent ones. I could not resist showing GDOT, the Green Dot Corporation, in view of my useful green dot signal on the charts (no real relation to GDOT, though).

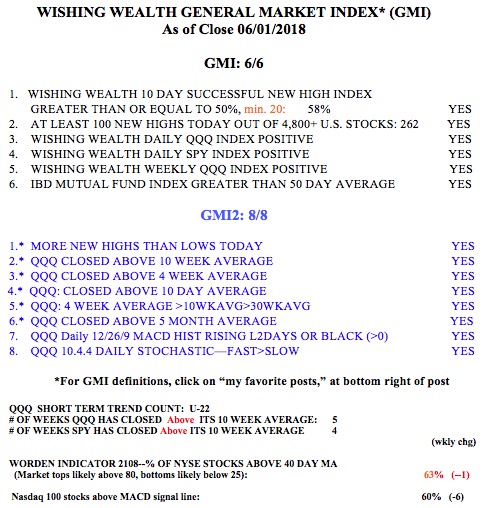

My general market index (GMI) remains on a Green signal and is at 6 (of 6). I always trade consistent with the general market’s trend. I therefore am wading back into this market on the long side. I even hold $TQQQ again.

Dr. Wish, can you elaborate what is a green dot signal? Thanks.

For detail on the green dot signal, see this recent post:

https://www.wishingwealthblog.com/2018/03/green-dot-strategy-defined/

Great, thanks for the link!