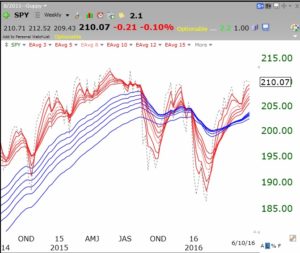

While my short and long term market trend indicators show an up-trend, my modified Guppy charts of the SPY and QQQ paint somewhat different pictures. My modified Guppy chart plots 6 shorter term and 6 longer term weekly exponential moving averages plus a dotted line showing each weekly close. This weekly chart of the SPY shows a clearly developed RWB up-trend. All shorter averages (red lines) are well above rising longer term averages (blue lines) with a white space separating them.

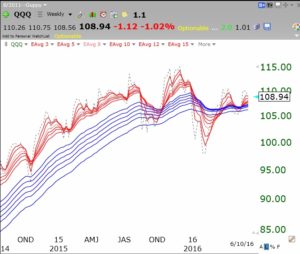

The chart of the QQQ is weaker, without a well defined RWB up-trend. The question remains, which index will lead the other?

The chart of the QQQ is weaker, without a well defined RWB up-trend. The question remains, which index will lead the other?

Nevertheless, the GMI remains at 6 (of 6). The current decline may be setting up for a nice snap back rally as we get end of quarter mutual fund window dressing at the end of June. And then on to 2nd quarter earnings. So I am watching the popular growth stocks for good entries and will tweet about stocks I think are bouncing on support (BOS). However, I will not post on this blog again until Wednesday night.

Must watch John Oliver on retirement plans. Excuse the language

https://m.youtube.com/watch?v=gvZSpET11ZY