Being on break from the university, I had time to run an analysis of the length of QQQ short term up and down-trends over the past 7 years. I went back and labeled each up and down-trend as they occurred according to the set of rules I have been using to post the QQQ short term trend changes on this blog. Note that a change in the QQQ short term trend is not the same as a change in the GMI status from buy to sell. The GMI includes components of both the short and longer term market trends. When the QQQ short term trend changes to down, I get out of my long positions in my trading accounts and sometimes go short the QQQ by buying an inverse ETF like QID or SQQQ.

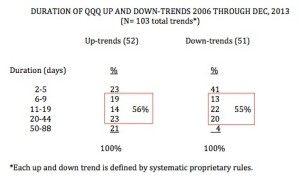

This table reveals some interesting results. There were a total of 103 up and down-trends in the study period. It is clear that up-trends lasted longer then down-trends. For example, 23% of the up-trends lasted 2-5 days, compared with 41% of the down-trends. I have always written that I am more sure of a change in trend when it lasts at least 5 days. But now I know that almost one half of the down-trends end within 5 days. I must not jump on a new down-trend too quickly. Once an up or down-trend persists beyond 5 days, it has about a 55% to 56% chance of lasting from 6-44 days. Finally, up-trends are 5 times more likely than down-trends (21% vs. 4%) to last 50 or more days. The two down-trends that did last this long occurred in the huge 2008 market decline.

This table tells me that with the QQQ short term up-trend passing its 54th day, this up-trend is likely near its end. But keep two things in mind. First, the up-trend could end, begin a brief down-trend, and then turn up again. Second, just like 2008 created two extremely rare long down-trends, this market could always produce an extremely rare up-trend longer than 88 days–but I would not bet on it….

Meanwhile, the GMI remains at 6 (of 6).

Given the many overbought indicators I see, I am still lightening up on my positions in my trading accounts. I am not taking on any new long positions.

Dr. Wish

Is it true then that you only use the GMI as confirmation of your short-term uptrend/downtrend indicator. That your buy/sell decisions are made for your trading account with the shorter term trend indicator.

Would it be possible to say a bit more about the other overbought indicators to which you allude and which prompted your decision to lighten up in your trading account?

I look at both the GMI and the short term trend.

My trading is based on the Gestalt (overall pattern) rather than fixed rules or individual indicators.

A veritable Fritz Perls!

Thanks