Wednesday was the 69th day of the current QQQ short term up-trend. I have written that I expected weakness for a few days, until first quarter earnings are released. The new earnings will give people reason to push stocks higher. The Worden T2108 Indicator fell to 44%, the lowest reading since it hit 30% last December, before the current up-trend began. There were only 52 new highs and 103 new lows. The last time we had as many new lows in one day was also in late December, 2011. The gold ETF, GLD, declined 2.68%, giving more evidence that it has entered a Stage 4 down-trend.

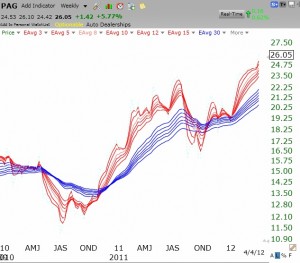

With the GMI at 5, I remain confident of the up-trend. I expect a resumption of the rise to take place when we receive first quarter earnings in about 10 days. When looking for stocks to buy it is sometimes useful to focus on those few stocks that are resisting the market weakness. Seven stocks came up in my scan that looks for stocks hitting a new 52 week high and having good earnings: ECOL,LO,PCLN,JBHT,PAG,CELG,IT. I will keep an eye on them. PAG is an RWB rocket stock that may be worth researching.

JUDY, are you keeping your shares of INVN or sold any? if you wish to share that here or in my email. I bought shares at abt $13 and $17. Thanks.

I was curious what you define as good earnings? Is it based on the CANSLIM 25% C A? If so LO & CELG would not qualify.