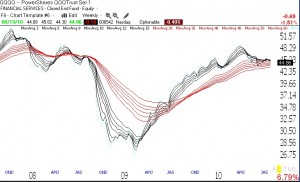

I think it best to cash out and wait on the sidelines. This market has not exhibited a steady trend for quite a while. And we are entering the dreaded September/October period. One thing about moving averages–they only work in a defined trend. The averages are flat and prone to whipsaws. See the GMMA weekly chart of the QQQQ below (click on to enlarge). Note the shorter (black) and longer term averages (red) are flat. Without a defined up or down-trend, I cannot trade stocks profitably.

You had mentioned you were doing a Webinar on Worden on 8/24 but I don’t see anything on their website. Has this been changed? They have a free workshop in Denver next weekend that I’m looking forward to attending. You have a great blog!

My next webinar is listed on Worden.com now. Thank you for your note.

I have my own set of indicators I’ve developed and they are saying that short-term we are in a down-trend. Shorter-term market internals — often act as a fairly reliable forecasting tool — are Negative. I would expect lower prices in the next few weeks. Long-term trends, as you seem to indicate, are flat, but appear to have topped and showing early signs of rolling over.