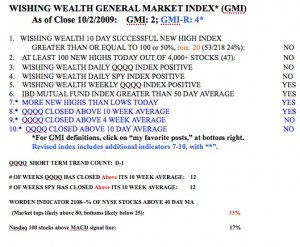

The sudden deterioration in the short term indicators is a little troubling to me. While I am defensive, the longer term weekly up-trends are still intact. Last month, the market weakened considerably early in the month, only to come charging back by options expiration. We do not know whether this pattern will repeat this month. October always brings out the bears. I am trying to hold on to the cash secured put positions I sold. As we get closer to expiration, on 10/16, the time value of the October puts I sold will decay, bring me profits. I am betting that the underlying stocks will not fall so far as to wipe out my profits. Then again, I would not mind having someone put to me shares of AAPL at $170! Meanwhile the GMI

is back to 2, with all of the short term indicators negative.  The GMI-R is at 4. The SPY and QQQQ have both closed above their 10 week averages for 12 weeks. If they can hang on, I am more optimistic about the longer term trends. If they close below their 10 week averages, I will probably go back to cash in my trading account. I don’t trade growth stocks profitably when that happens. My longer term funds remain 100% invested in mutual funds in my university’s pension plan. Meanwhile, the Worden T2108 Indicator is at 53%, in a neutral area…

The GMI-R is at 4. The SPY and QQQQ have both closed above their 10 week averages for 12 weeks. If they can hang on, I am more optimistic about the longer term trends. If they close below their 10 week averages, I will probably go back to cash in my trading account. I don’t trade growth stocks profitably when that happens. My longer term funds remain 100% invested in mutual funds in my university’s pension plan. Meanwhile, the Worden T2108 Indicator is at 53%, in a neutral area…

By the way, this weekly chart of STEC looks quite weak to me, after a seven fold rise. STEC has closed below its 10 week average (dotted line) after a  long run (about 34 weeks) above it. It is often an ominous sign when a leader falters. As long as it remains above its 30 week average (red line) I consider STEC to be in an up-trend. But I tend to exit when a growth stock closes below its 10 week average, especially with high down volume (not shown), like STEC……

long run (about 34 weeks) above it. It is often an ominous sign when a leader falters. As long as it remains above its 30 week average (red line) I consider STEC to be in an up-trend. But I tend to exit when a growth stock closes below its 10 week average, especially with high down volume (not shown), like STEC……

Now it is a short term downtrend, but it the market continues its long-term uptrend then this period of short-term weakness will look like it was a great time to put some more money into ETFs in retrospect. TYH will open above around $126 this morning – wasn’t that a significant support level for it to bounce off of?

Yes, TYH better hold around 123.00 level.

A question about your money management, Dr Wish. When you buy or sell TYH in your trading account, do you go from 0% invested to 100% invested in one fell swoop, or do you scale in and out over a period of days?

I would NEVER put 100% of my money in anything. Technical analysis gives me an edge, but unexpected failures can and do happen anytime. I rarely buy more than 100 shares of TYH at a time. If I did it would be during a long trend where I gradually added more and raised my stops to protect me.