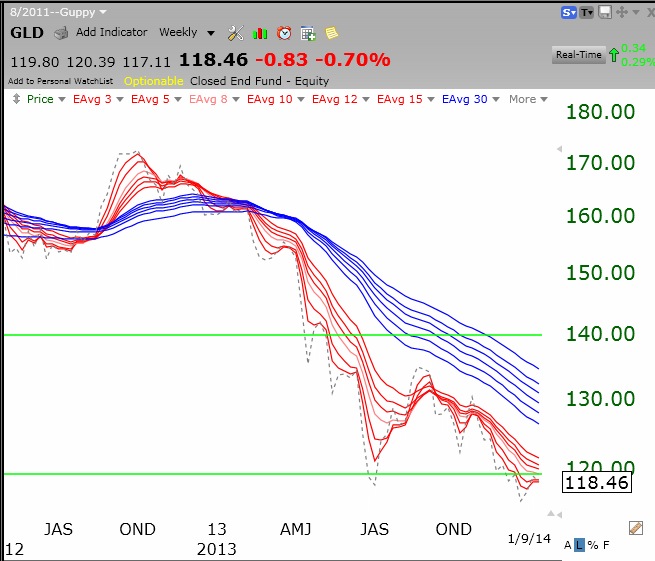

Yesterday I showed you the RWB rocket stock pattern and how it helps me to identify strong stocks. Tonight I will show you the reverse, the BWR pattern, that can keep me out of stocks in a major down-trend. You can see from this weekly Guppy chart of GLD, how it alerted me early on to the down-trend in gold. Who in their right mind should have been long gold in 2013?

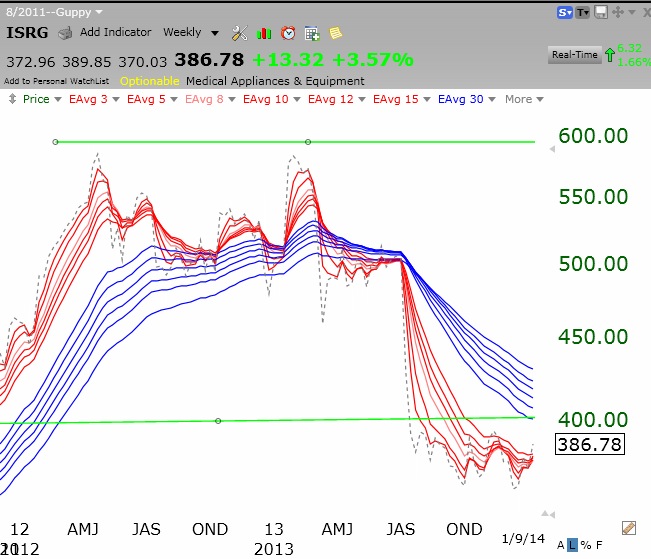

This chart shows ISRG’s transition from an RWB up-trend into a BWR down-trend.

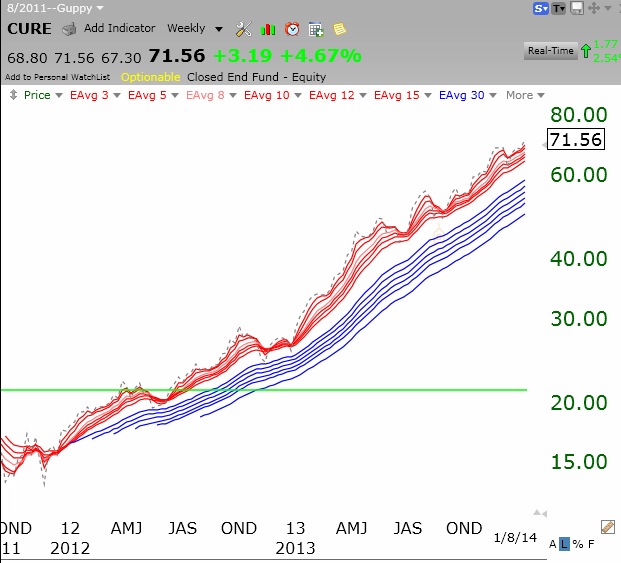

A weekly Guppy chart is all I need to determine the longer term trends of a stock, ETF or mutual fund. Guess what pattern the Dow has……..