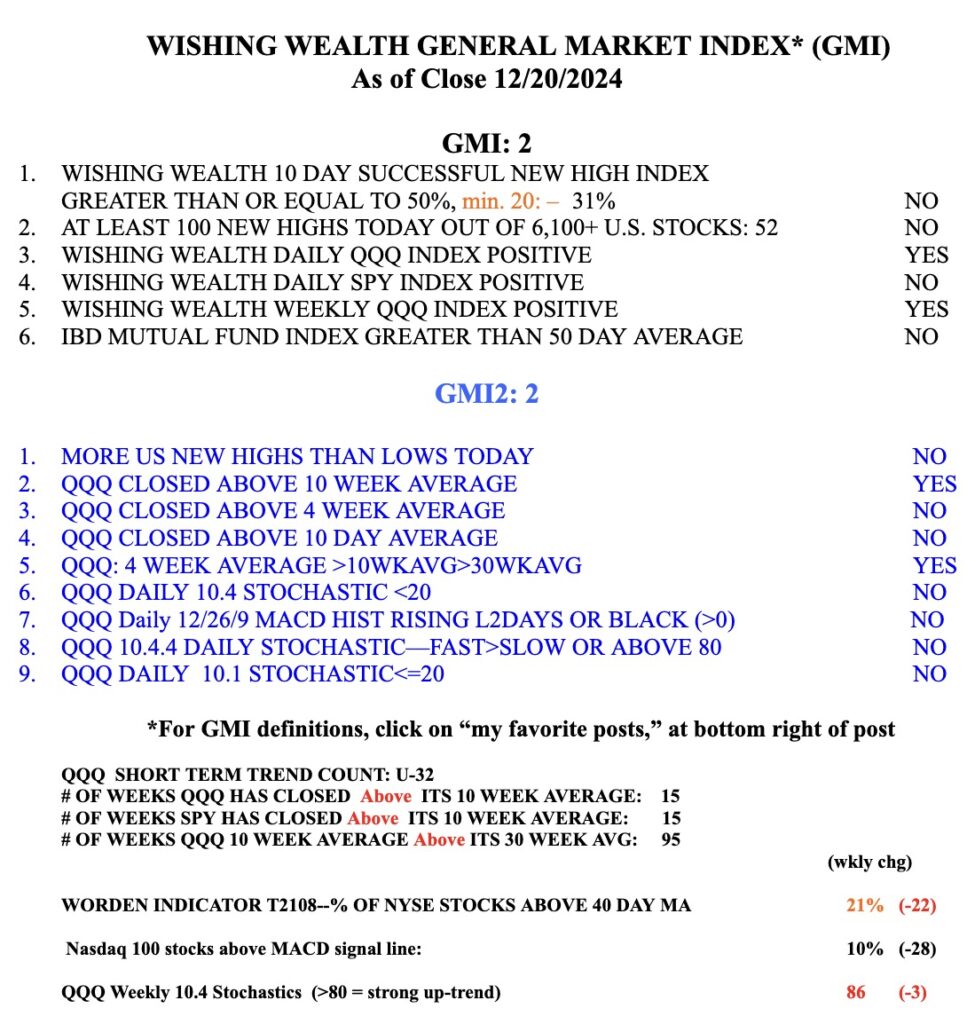

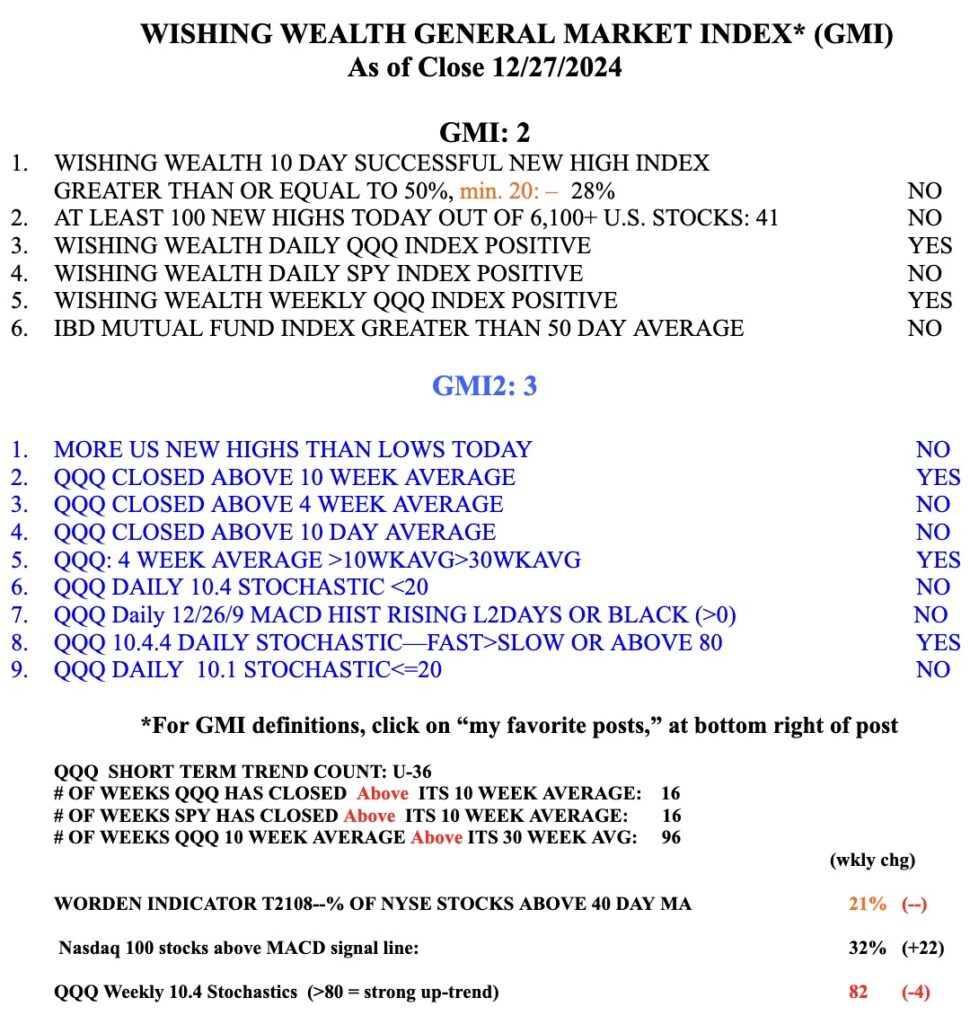

While the market indexes remain above key moving averages, I am concerned about what is happening under the hood. Few stocks are hitting 52 week highs or all-time highs. There were more lows than highs on Friday. And the GMI=2 and is flashing RED. I remain mainly in cash in my trading accounts. I will not retreat in my longer term university mutual fund accounts until I see longer term averages give way and turn down. I am also concerned because so many stocks I have been following have had non-stop advances. Many persons may have been waiting until 2025 to take their gains so that they will not incur 2024 taxes. We must be very careful right now.

Screenshot