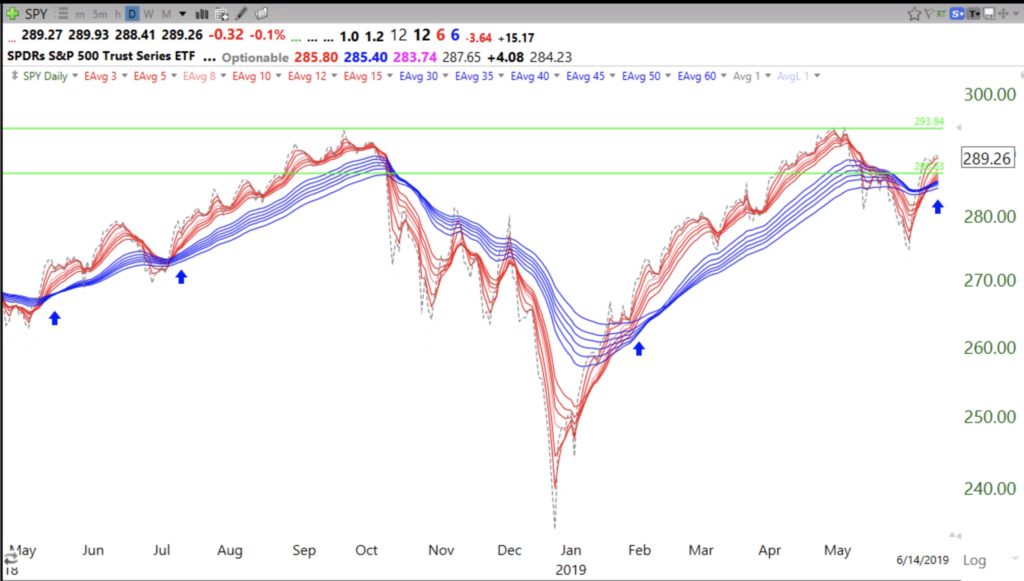

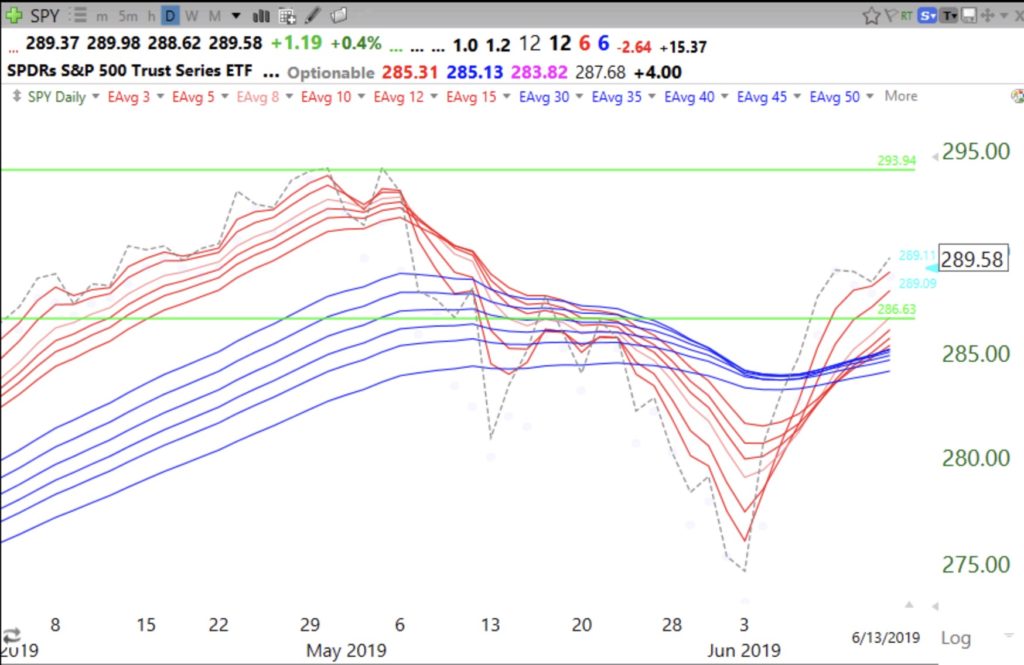

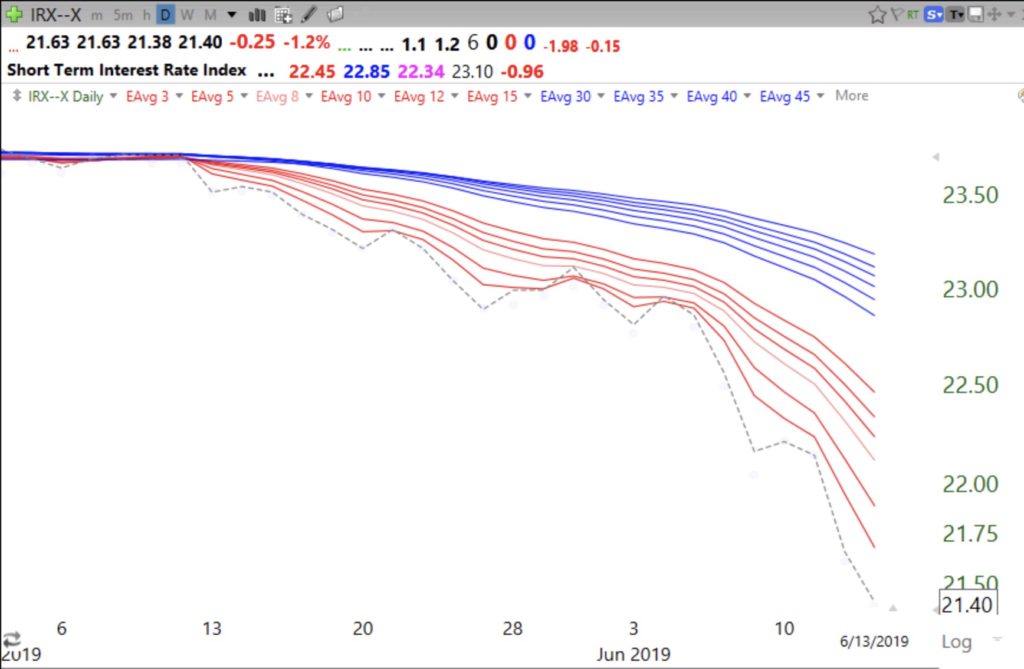

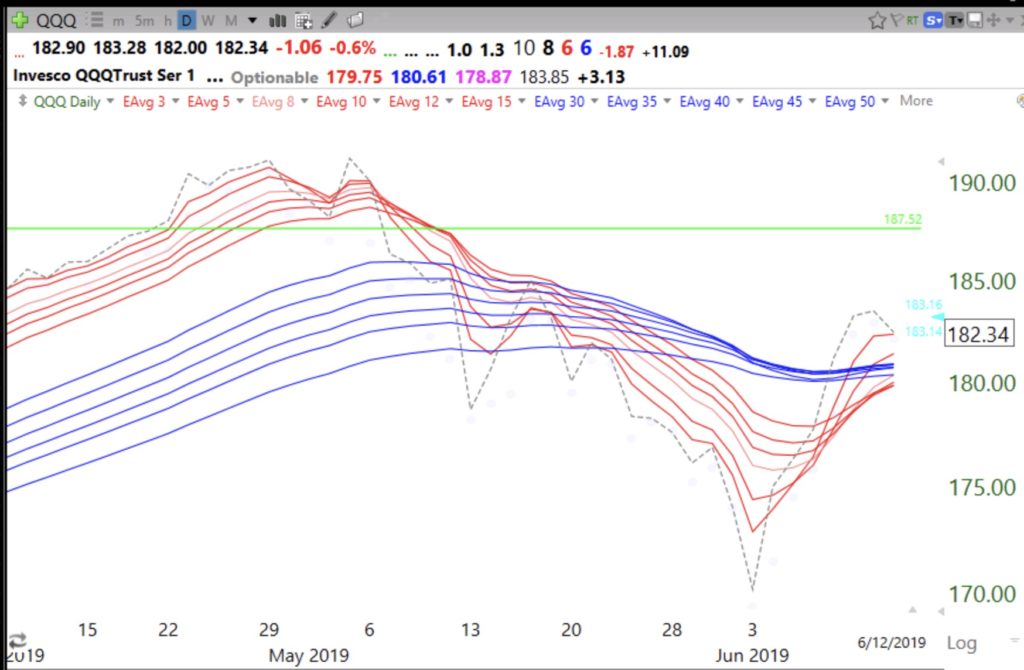

I am watching for the beginning of a new significant up-trend in the major index ETFs. I define an RWB up-trend using 12 exponential moving averages and the close. A daily RWB up-trend is when the 6 red shorter daily averages are rising above the 6 blue longer daily averages so that there is a white space separating them. The beginning of a daily RWB up-trend starts with the closing price (dotted line) rising above all 12 averages. Next the red lines climb above the blue lines. The chart below has arrows showing the start of four RWB up-trends. It looks like the SPY is beginning an RWB up-trend but there is no visible white separation yet. If the RWB pattern matures, the market is headed higher. During most of an RWB rise, the closing price leads all of the averages higher. A failure of the RWB pattern would occur if the SPY were to close back below all 12 averages and the white separation disappears. We are approaching the end of second quarter and the likely mutual fund window dressing period, so it would not surprise me to see an up-trend develop. The DIA’s pattern looks like the SPY’s but the QQQ is a little further behind. These patterns help me with individual stocks too. It is important to study the market’s behavior, ignore the news and media pundits, and to pull the trigger only after a signal has occurred, not before.

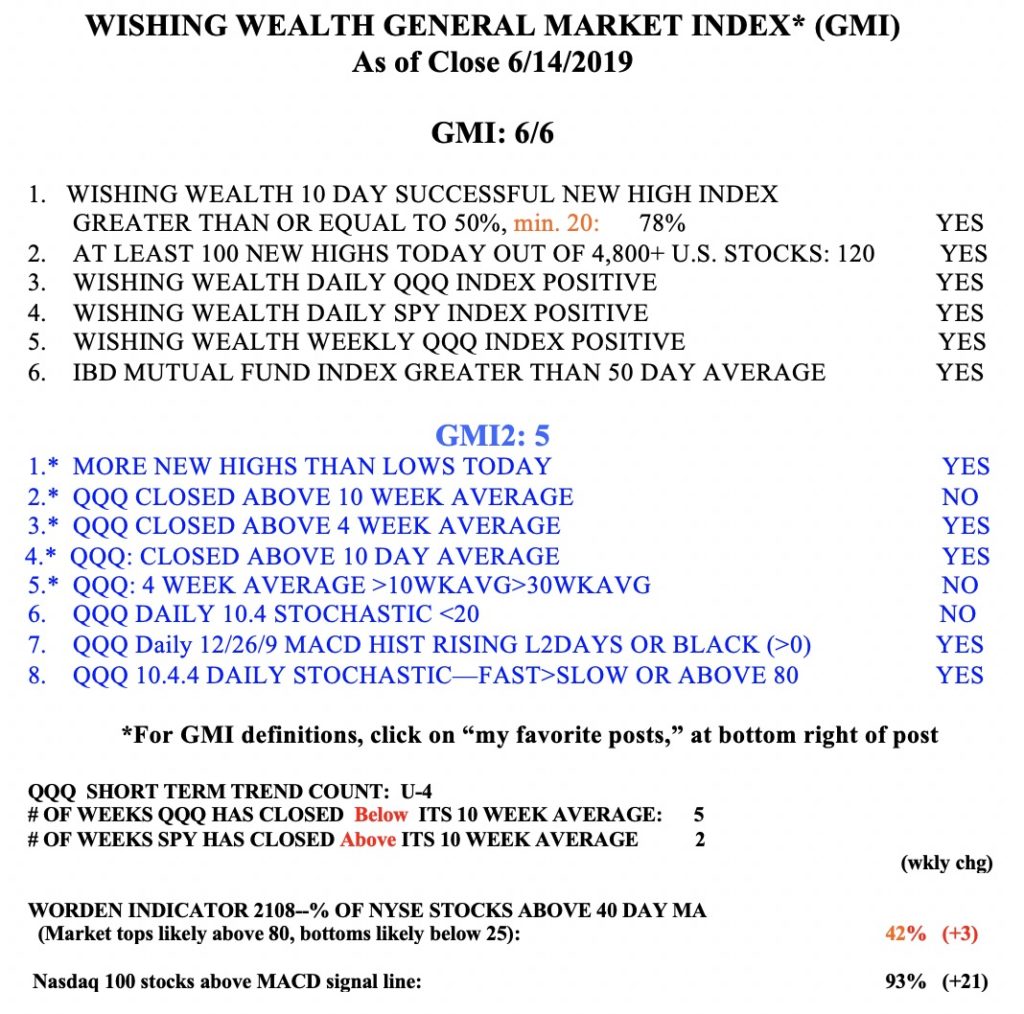

The GMI=6 and Green.