Gold (GLD) revives as dollar (UUP) plummets.

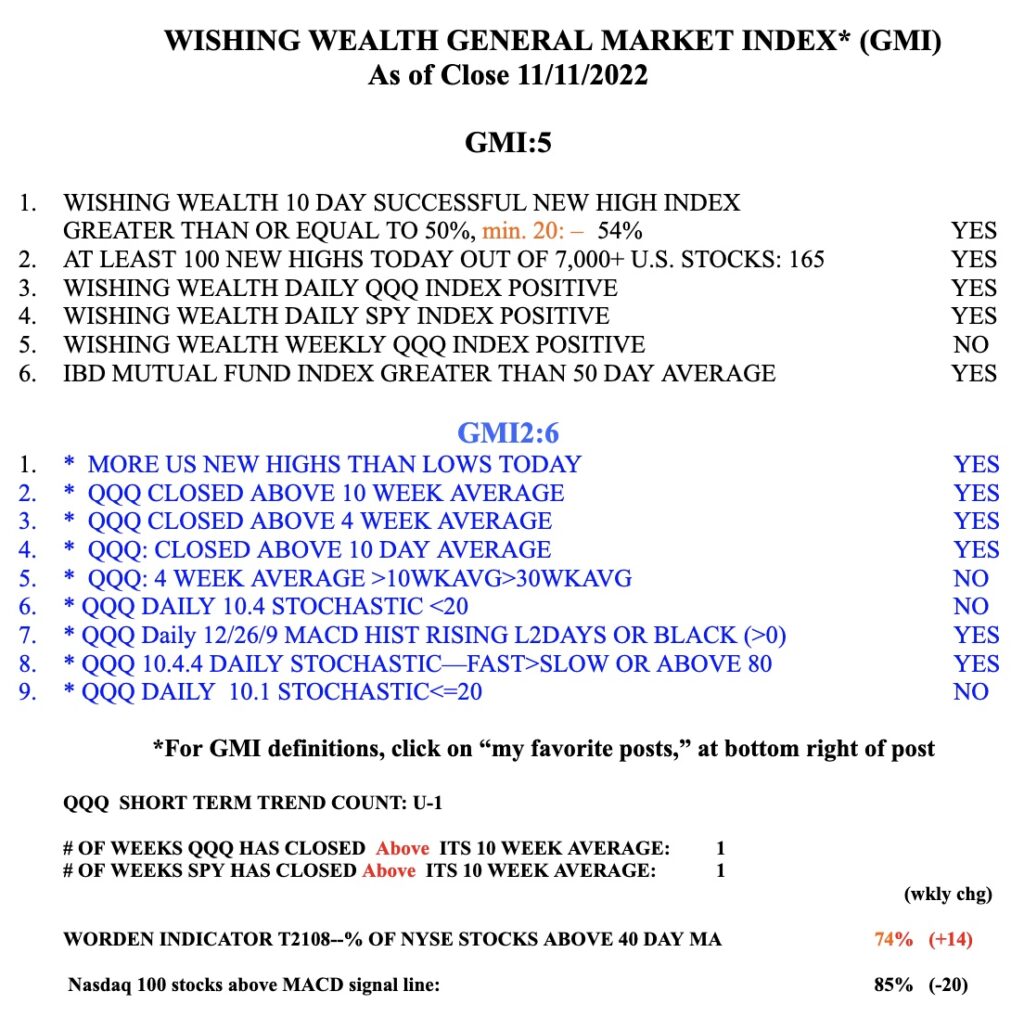

Blog Post: New $QQQ short term up-trend; GMI= 5 and remains on a Green signal since 10/26; Can 10wk average retake 30 wk? See weekly 10:30 charts of $QQQ and $DIA

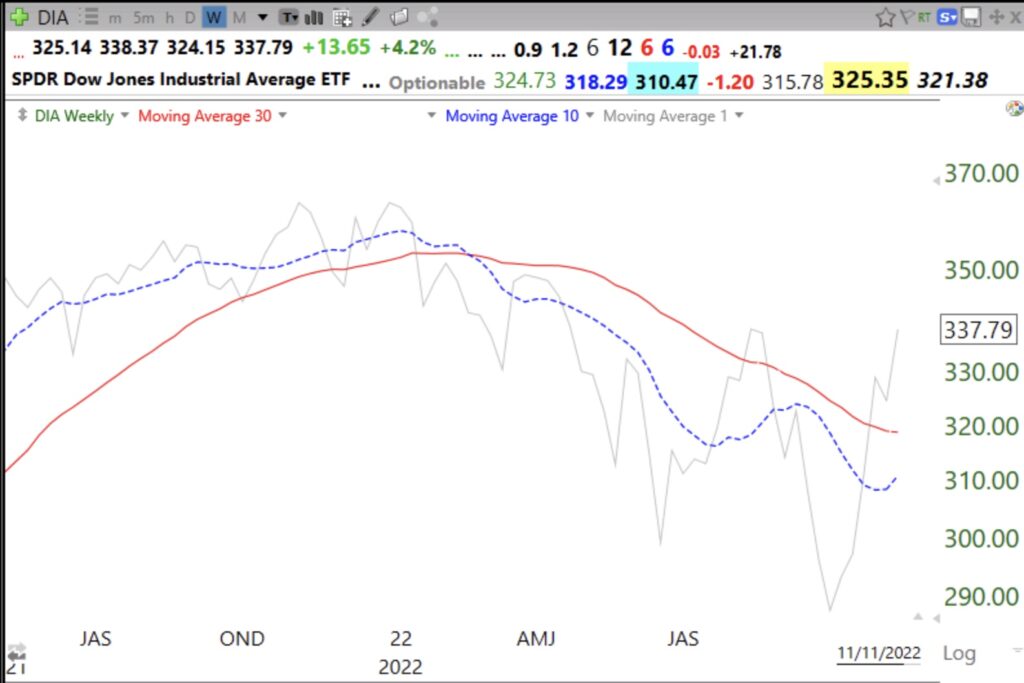

I will be looking for a true change in the market’s trend when the 10 week average (blue dotted line) retakes the 30 week average (red solid line) and the 30 week average turns up. Until then, I am less confident of a true change in the longer term trend of QQQ or DIA. The gray solid line is the weekly close

DIA is stronger but not there yet.