I happened to notice that BIDU and BABA had strong advances on Wednesday. So I looked at my watchlist of world stock ETFs and was amazed to find so many China ETFs above their 30 week averages and maybe beginning Stage 2 up-trends. Here are just two of many examples. Note the huge volume on some recent up weeks. Maybe China is having a postCovid lock-down recovery? It is nice to see some major stock indexes entering Stage 2.

Blog Post: Day 10 of $QQQ short term down-trend and GMI still Red; $NVO, maker of obesity drug, Wegovy, barrels ahead to close at ATH after recent GLB–60 Minutes story to propel it higher?

On Sunday, 60 Minutes had a feature story about how obesity is being increasingly seen as a medical condition that can be treated by the new generation of drugs for diabetes that reduce weight considerably. These drug injections are very expensive and not covered by most medical insurance for treating obesity. Hollywood stars are most likely able to afford this treatment. However, on Sunday, 60 Minutes announced that Rhode Island will now cover the cost of such drugs for state employees to treat obesity. NVO’s drug, Wegovy, should benefit from this new breakthrough in insurance coverage and may explain why the stock has been so strong. GLBs have often failed this year but if one bought the GLB of NVO on November 30, one would currently be up +8.5%. This chart specifies the day of the GLB (green line break-out). NVO has closed the year at an ATH (all-time high). LLY is also working on a similar drug and may benefit too.

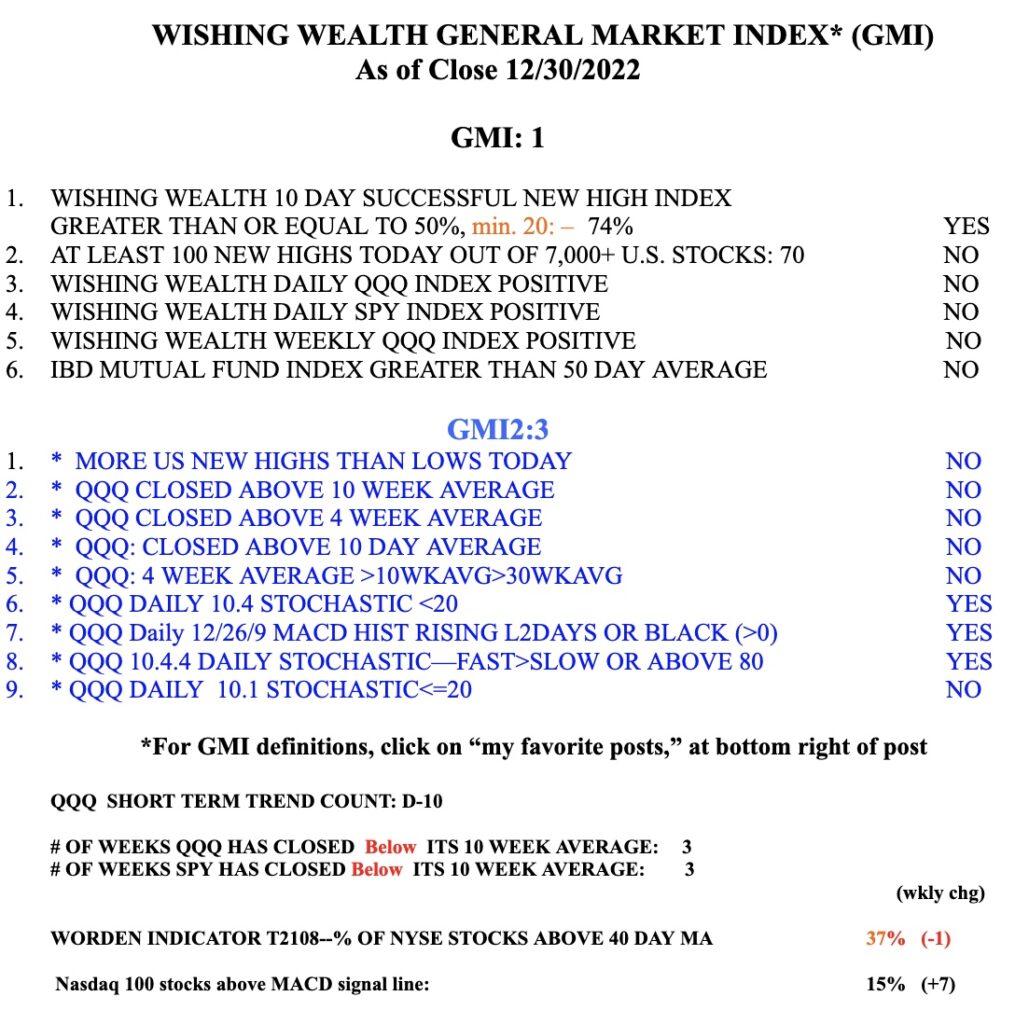

The GMI is 1 (of 6) and still on a Red signal.